Business Incorporation Services

Strategic Business Incorporation Consultation & Management Services

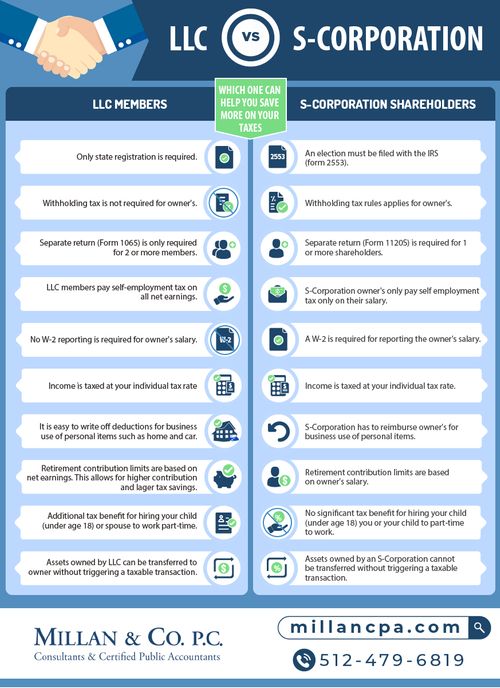

When beginning a business, you must decide what form of business entity to establish. Your form of business determines which income tax return form you have to file. The most common forms of business formations are:

- sole proprietorship

- partnership

- corporation, LLC

- S corporation

A Limited Liability Company (LLC) is a relatively new business structure allowed by state statute. Legal and tax considerations significantly factor into selecting a business structure.

As part of the Corporate Transparency Act, the U.S. Justice Department will soon (by 1.1.24) be requiring disclosure of beneficial owners of LLCs. We are here to assist with the new regulations on filing Beneficial Ownership Information Reporting Rule (BOI) to comply with the U.S. Department of the Treasury's Financial Crimes Enforcement Network (FinCEN).

In addition to our main business incorporation services that include entity consultation and review, Millan & Company offers all the services related to state and federal tax analysis and filings, as well as assisting with ownership structure and investor relations. A business with investors can be complex – we make sure it’s done professionally by administering the return of investment and helping interpret legal documents for an investor prospectus.