Section 179D Updates

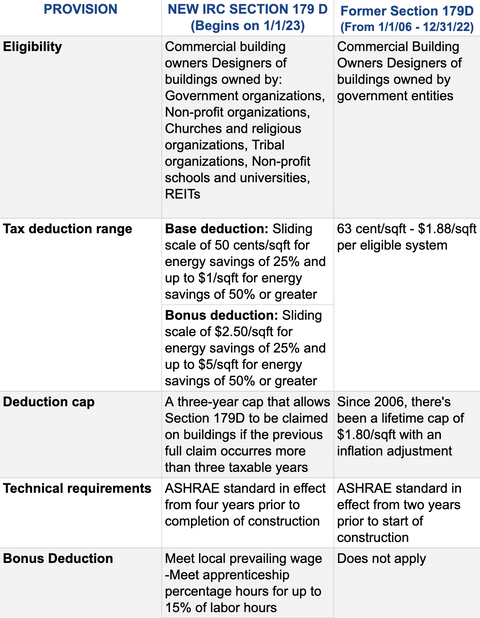

The Inflation Reduction Act of 2022 substantially increases the Internal Revenue Code (IRC) Section 179D energy-efficient commercial building deduction, which will benefit the architecture, engineering, and construction (AEC) industries and also commercial building owners or designers.

These changes are to qualifying property placed in service after December 31, 2022.

Who Qualifies?

The Inflation Reduction Act now allows credits to designers of commercial buildings owned by tax-exempt entities, including not-for-profit organizations, churches and other religious organizations, tribal organizations, and not-for-profit schools and universities.

This is a significant increase in scope to the current requirements, which is limited only to commercial building owners and designers of buildings owned by government organizations.

The new provisions in the act expand eligibility for companies claiming Section 179D to include Real Estate Investment Trusts (REITs), which are companies that operate, own or finance income-producing real estate.

Improved Qualification Thresholds

The new qualification threshold for credits is now set to 25% energy cost savings, with a base deduction equal to 50 cents per square foot (sqft) and bonus deduction equal to $2.50/sqft.

Also, the act increases the deduction on a sliding scale for each percentage point above 25% when energy usage is reduced. The expansion of the increase will be capped at a 50% reduction with the base deduction set at $1/sqft and bonus deduction equal to $5/sqft.

The current tax deduction range was 63 cents per square foot for each of the three eligible areas, which are HVAC and hot water, internal lighting, and building envelope to a maximum amount of $1.88 per square foot.

A New Bonus Deduction

The bonus deduction previously is available to those companies that meet the local prevailing wage and apprenticeship requirements for all laborers and mechanics employed by the taxpayer or contractors associated with the installation.

Updates ASHRAE Standard Requirements

The act now states that projects must be measured against the American Society of Heating, Refrigerating and Air-Conditioning Engineers (ASHRAE) standard from four years prior to completion of construction.

This is a change from previous provisions, which is the ASHRAE standard in effect from two years prior to the start of construction.

A New and Alternate Deduction Path

The act creates an alternate deduction path for renovation efforts based on reducing a building’s energy-use by 25% or more.

Specific Section 179D Changes

The increases in requirements of the changes to Section 179D are outlined below and illustrate the level of complexity in the new code.