The Fair Tax Act of 2023: What You Should Know

Webmaster

Fair Tax Act Article Summary

- What is the “Fair Tax”?

- History of a “Fair Tax” in the U.S.

- Fair Tax Act data – proposed base and rates (29.8%)

- Abolishment of the IRS

- State contracts with the US Treasury

- The proposed Fair Tax prebate concept (and data)

- Fiscal and cultural implications of the Fair Tax Act

- Current U.S. legislative support for the Fair Tax Act

What is the "Fair Tax Act" proposal?

The problem the Fair Tax Act aims to resolve is replacing the existing progressive based income tax based system (where the more you make, the more you pay) with a consumption tax – which is a type of regressive tax – (where the tax rate decreases as the amount subject to taxation increases).

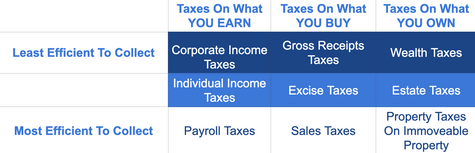

Changing the federal tax system from taxing income towards taxing consumption makes headway towards pro-growth and simplified tax code goals. Taxing consumption is a less economically damaging method of raising revenue compared to taxing income and is considerably more straight-forward for individuals to maneuver and the government to administer.

In its current form, the proposed Fair Tax Act is a plan to implement a national sales tax and rebate system that would dissolve the IRS and replace the following sources of federal revenue: corporate income tax, payroll tax, individual income tax, and estate and gift taxes.

Consumption taxes do not place an economic burden on savings or investments and, as such, are considered to be more economically efficient than income taxes. Critics of the Fair Tax plan estimate a reduction in total tax revenue and, more than likely, a regressive tax structure in comparison to taxes paid with income tax rates.

Consumption taxes are typically regressive where the average tax burden decreases with income. Lower-income households typically spend more of their incomes than they save. Due to this, regressive taxes are sometimes portrayed as “a gift to the rich” if a rebate or credit system is not included. The Fair Tax Act, as currently written within the bill, does contain a rebate system based on income.

There are also significant, broad, financial and cultural implications that must be considered in the plan and those will be covered in more detail within this article.

A Hierarchy of Tax Types

History of a “Fair Tax” in the U.S.

A national sales tax has basically been advocated as a replacement to an income tax since 1932 when it failed a House of Representatives vote.

The latest rendition of this model is the FairTax Act, which has been introduced in every Congressional session since 1999. Since the late nineties, efforts to have it pass committee have been futile. Most recently, under the newly elected Congress, proponents of the plan have supposedly received a commitment to a floor vote as part of the negotiations that elected Kevin McCarthy (R-CA) to the House Minority Leader role.

Kevin McCarthy (R-CA) has reportedly promised a floor vote for the Fair Tax Act as part of the negotiations which helped secure his role as U.S. Congress House Minority Leader on Jan. 5th, 2023.

Flat Tax Act data – proposed base and rates (29.8%)

Tax rates can be stated in tax-inclusive or tax-exclusive terms. Tax-inclusive rates compare the tax paid to the total price including taxes. Tax-exclusive rates compare the tax paid to the price excluding taxes.

Proponents of the Flat Tax bill say it provides for a 23% national sales tax where the percentage is determined by using tax-inclusive rates – dividing the tax by the total amount paid for a good or service, which includes taxes.

Example: A purchase is made for $1000 and there is a $300 tax. The formula would be $300 divided by the price fully paid, $1,300. That tax rate is 23%.

The FairTax Act suggests a tax-inclusive rate of 23 percent, but taxpayers are used to an everyday tax-exclusive rate in the same manner in how state sales taxes are calculated. The FairTax Act would result in a tax-exclusive sales tax rate of about 30 percent (29.8 percent), meaning for every $1 spent, taxpayers would pay about 30 cents in sales taxes to the federal government.

The Fair Tax proposes a levy of a national retail sales tax to goods and services broadly, covering an estimated 90 percent of consumption which is roughly 61% of GDP. Maintaining a broad tax base would be key to preventing any tax rate increases in the future.

In practice, the new method would have to ensure the exemption of business inputs to prevent taxing a good or service more than once, which results in tax pyramiding.

The Fair Tax Act proposal calls for the abolishment of the IRS.

Abolishment of the IRS and repeal of the 16th Amendment

Provisions of the Fair Tax bill call for abolishment of the IRS and a repeal of the 16th Amendment of the U.S. Constitution. Should the IRS somehow remain in-place and the sales tax revenue end up merely being added to a new form of the income tax, the Fair Tax bill contains a dissolution provision, or would “sunset”, should the 16th Amendment fail to be repealed.

Some critics, such as Representative Kevin Hearn, R. Okla., argue that a tear down of the IRS wouldn’t save any money, however, others emphasize that streamlining the complex processes associated with corporate income tax, payroll tax, individual income tax, estate and gift taxes would be well worth the mammoth change.

The Fair Tax bill specifies that the United States Treasury Department would replace the IRS to oversee future tax revenue collection at the federal level.

State contracts with the U.S. Treasury

The Fair Tax bill proposes that the United States Treasury Department and state governments set contracts where states would execute their respective portions of the national sales tax. Most U.S. states employ and enforce a state-level sales tax and the Flat Tax could efficiently be added to those systems.

The national sales tax proposes incentives for states whereby they retain a .25% portion of all taxes collected within their state jurisdiction, which conceivably allows for the replacement for the IRS.

States could not be compelled to enter into contracts, only incentivized, which could create considerable turmoil in the attempt to implement a legitimate and principled system should rates and agreements vary significantly from one state to another. States could also create issues by keeping more, or delaying payments, of the tax revenue than originally agreed to within their individual contracts with the U.S. Treasury.

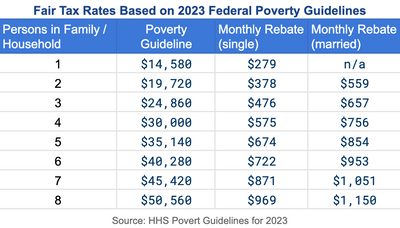

The proposed Fair Tax prebate concept (and data)

n order to compensate for the degree of regressivity, and its impact upon lower wage income earners, the Fair Tax plan offers the concept of a “prebate”, which some say amounts to an “entitlement” program versus a “value added tax’ or VAT (also known as a GST or “goods and services tax).

The Fair Tax is envisioned to provide a prebate to make up for the fact that it is a regressive tax. The prebate would be issued by the U.S. Treasury to every household in the U.S.

While the concept of a prebate does make up for the fact that the plan is a regressive tax and it does help to protect the poor, conservatives are worried that it amounts to an entitlement program, or a form of welfare, since citizens would be receiving this money from the government- possibly in the form of debit cards with an identification number on it.

Fiscal and cultural implications of the Fair Tax Act

The U.S. tax revenue system has been based on an income tax for over 100 years. Converting to an entirely distinct structure would have immense social and fiscal effects.

Removing the IRS or income tax equals no tax returns or tax return preparation industry. The tax software industry would become instantly useless and the future for CPAs would become relatively grim.

401(k)s, IRAs and Roth accounts become useless since they are based on a deferred tax benefit, are no longer sheltered and become subject to sales tax on any future purchases.

Current U.S. legislative support for the Fair Tax Act

The Fair Tax bill will likely need to pass the House Ways and Means Committee prior to a floor vote

Democrats are characterizing the Fair Tax Act as a mainstream GOP proposal to cut taxes on the wealthy, undermine Social Security and Medicare and the bill stands little chance of passing a Democrat-controlled Senate. The bill also does not currently seem to have broad support within the Republican House.

Now that House Republicans are returning to what is known as regular order, the bill would likely have to go through a committee of jurisdiction, in this case the House Ways and Means committee, where it currently only has a single committee sponsor. However, there are over 20 Republican Congressmen who support the bill outside of the House and Ways Committee. Although this bill has been reported to have been promised a floor vote, it appears to have little chance within the current legislature.

Millan & Co. is Here to Assist You

Our comprehensive approach allows our unique clients to confidently navigate the complexities of taxation as new laws are implemented into the tax code.

Contact us to learn how we can help you create a strategy that meets your goals.