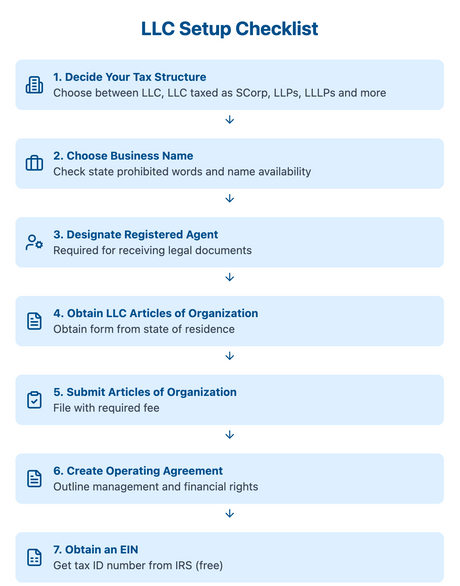

LLC Setup Checklist

(For LLCs, LLCs taxed as an S Corp, LLPs, LLLPs and more).

- Decide your tax structure. This could be an LLC, LLC taxed as an S Corp, Multi Member LLC - there are more, but these are the most common. This is a critical step that can affect your tax liability for years to come. We are here to help with any questions.

- Decide on your business name. This is important, it's how people will associate your business! You'll want to check with the state on the list of prohibited words for business names and make sure your name isn't already in use.

- Designate a registered agent. An LLC is legally required to have a designated Registered Agent, who receives official legal documents and passes them on to the LLC owner.

- Get an LLC Article of Organization form from your state. This is a document that includes basic information about your LLC and establishes it as a separate legal entity.

- Submit the completed Articles of Organization form, with the required filing fee.

- Create your LLC Operating Agreement. This outlines the management and financial rights of all LLC members (even if it's just you). This isn't required, but recommended.

- Obtain an EIN. You'll use this number to complete your business taxes (instead of your Social Security number) and to open a business bank account and hire employees. Get an EIN in minutes for free (via IRS)!