Business Incorporation Services

Strategic Business Incorporation Consultation & Management Services

When beginning a business, you must decide what form of business entity to establish. Your form of business determines which income tax return form you have to file. The most common forms of business formations are:

- sole proprietorship

- partnership

- corporation, LLC

- S corporation

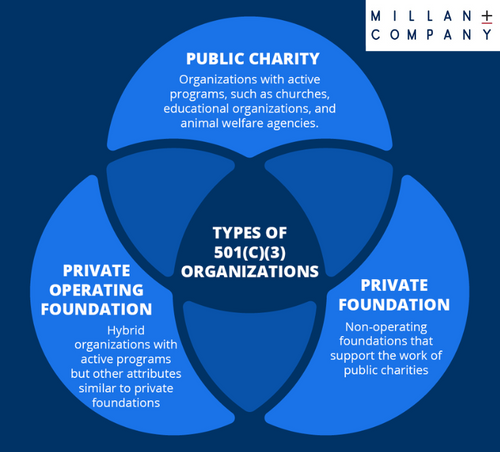

- Nonprofit organization

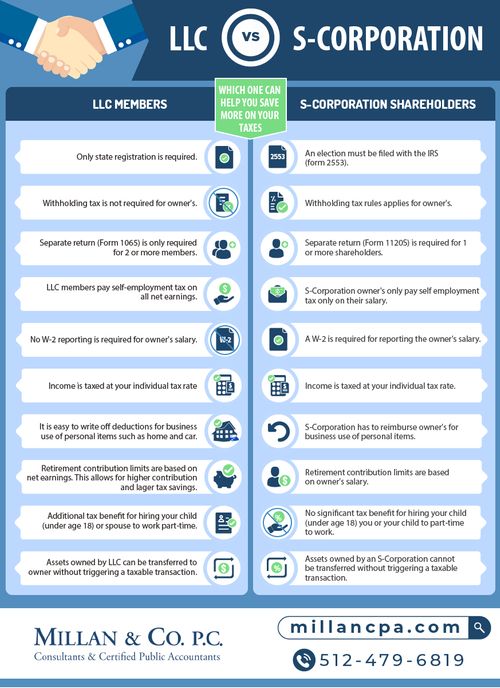

A Limited Liability Company (LLC) is a relatively new business structure allowed by state statute. Legal and tax considerations significantly factor into selecting a business structure.

In addition to our main business incorporation services that include entity consultation and review, Millan & Company offers all the services related to state and federal tax analysis and filings, as well as assisting with ownership structure and investor relations. A business with investors can be complex – we make sure it’s done professionally by administering the return of investment and helping interpret legal documents for an investor prospectus.

Types of 501(c)(3) Organizations

Strategic Structuring Benefits

When done correctly, business entity formation, structuring and restructuring can help:

- Reduce business insurance costs;

- Streamline and reduce the amount of quarterly and annual IRS paperwork;

- Protect assets;

- Provide privacy benefits as it relates to public records;

- Enable management continuity;

- Provide protection from legal partition actions;

- Lein attachment avoidance;

- Probate efficiency;

- Streamlined refinancing processes;

- Reduce and eliminate closing costs;

- Tax savings

Contact us to see how we can help save you time and money as it relates to your business objectives. We focus on providing the highest level of customer satisfaction and look forward to working with you.