Do you want to form a nonprofit organization? What tax-exempt entity status should you choose? Should you select Section 501(c)(3), Section 501(c)(4), or Section 527 of the Internal Revenue Code?

Entities that are tax-exempt under Section 501(c)(3) of the Internal Revenue Code are generally public charities. These nonprofit organizations are organized and operated exclusively for religious, charitable, scientific, literary, or educational purposes. Donations to these organizations are tax deductible as charitable contributions.

Entities that are tax-exempt under Section 501(c)(4) of the Internal Revenue Code are generally social welfare organizations. Social welfare organizations are similar to public charities. Many public charities could also qualify as social welfare organizations. Social welfare organizations are less restrictive in their requirements to be tax-exempt since donations to these organizations are not tax deductible as charitable contributions.

Entities that are tax-exempt under Section 527 of the Internal Revenue Code are political organizations. These organizations have the primary purpose of influencing federal, state, or local elections.

Section 501(c)(3) of the Internal Revenue Code allows for tax-exempt status generally for public charities. Entities that can request Section 501(c)(3) status from the Internal Revenue Service (IRS) include corporations, trusts, and associations. The vast majority of Section 501(c)(3) organizations are nonprofit corporations. Donations to Section 501(c)(3) organizations are tax deductible. Donations to most other tax-exempt organizations are not tax deductible as charitable contributions. Also, most states allow for deductibility for state income tax purposes, if the state has an income tax. These organizations can also be exempt from state sales taxes on purchases and from state and local property taxes.

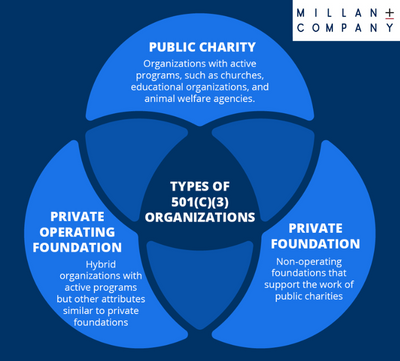

A public charity under Section 501(c)(3) is generally defined as not a private foundation. A public charity must receive a substantial portion of its revenue from the general public or from the government. In order to remain a public charity, and not a private foundation, the public charity must obtain at least one-third of its donated revenue from the general public. Also, public charities must maintain an independent governing body. Public charities must have active charitable programs.

Section 501(c)(3) public charities are highly regulated entities. Strict rules apply to both the activities and the governance of these organizations. None of the directors or officers can benefit unfairly from the activities or the net income of a public charity. Also, lobbying must be kept at an insubstantial level. Involvement in political campaigns of candidates for public office is strictly prohibited.

These organizations apply for tax-exempt status from the IRS by filing IRS Form 1023 or Form 1023-EZ. Also, these tax-exempt organizations must file an annual IRS Form 990, Form 990-EZ, or Form 990-N to report their charitable and financial activities for the year.

Section 501(c)(4) of the Internal Revenue Code allows for tax-exempt status for social welfare organizations. An organization is operated for the promotion of social welfare if it is primarily engaged in promoting in some way the common good and general welfare of the people of the community. This includes nonprofit organizations operated primarily for the purpose of bringing about civic betterments and social improvements. There is some overlap between Section 501(c)(3) public charities and Section 501(c)(4) social welfare organizations. Many public charities could also qualify as social welfare organizations. The qualifications for status as a social welfare organization are less demanding than the qualifications to be treated as a public charity. This is because there is not a charitable contribution deduction to Section 501(c)(4) social welfare organizations. It is possible to get a business expense deduction in some cases for a contribution to a social welfare organization.

Lobbying in favor of legislation relevant to the social welfare organization’s programs is permitted. A Section 501(c)(4) social welfare organization may further its exempt purposes through lobbying as its primary activity without jeopardizing its exempt status. A Section 501(c)(4) organization may not engage in political activity as its primary purpose. However, a social welfare organization may engage in some political activities as long as these activities are not the primary activity.

IRS Form 1024-A is used by organizations to apply for recognition of exemption under Section 501(c)(4) of the Internal Revenue Code. A social welfare organization files an IRS Form 990 annually to report its annual financial operations and its nonprofit activities.

A public charity is tax-exempt under Section 501(c)(3) of the Internal Revenue Code. A social welfare organization is tax-exempt under Section 501(c)(4). What are the differences between these two types of tax-exempt entities? A charitable purpose and a social welfare purpose are very similar. There is substantial overlap in their meanings. Many organizations could qualify for exempt status under either section of the Code. However, there are some major differences between these two types of organizations.

Both Section 501(c)(3) public charities and Section 501(c)(4) social welfare organizations are exempt from federal income taxes on the income raised or earned related to their exempt purposes. Public charities are eligible to receive tax deductible charitable contributions. Contributions to Section 501(c)(4) organizations are not deductible as charitable contributions. These organizations must disclose in any fundraising solicitations that contributions to the organization are not deductible for federal income tax purposes as charitable contributions. Some payments to social welfare organizations may be deducted as business expenses in certain circumstances.

Public charities may engage in some lobbying as long as these activities are insubstantial in relation to their overall activities. Insubstantial lobbying activities are considered to be about 5% of annual expenditures. If the organization makes the Section 501(h) election, it can engage in lobbying activities up to 20% of the annual expenditures. Social welfare organizations may engage in unlimited lobbying activities in furtherance of their social welfare purposes. In making the decision to be a public charity or a social welfare organization, the organization founders must decide if it is worth giving up the tax deductible charitable contribution of the public charity for the unlimited lobbying expenditures limit of the social welfare organization. Also, public charities are prohibited from engaging in any political campaign activities in any way. Social welfare organizations may engage in political campaign activities as long as these activities are not the primary activity of the organization. Social welfare organizations can spend up to 49% of their expenditures on political activities.

Political organizations under Section 527 of the Internal Revenue Code have the primary purpose of influencing federal, state, or local elections. Political organizations are taxed only on certain income called political organization taxable income. This is the organization’s gross income, excluding exempt function income, less $100 and any allowable deductions. The income tax rate is generally the highest corporate income tax rate.

In conclusion, in general the level of desired lobbying activity and the level of desired political activity determines the choice of tax-exempt entity type. A public charity status allows the organization to engage in an insubstantial amount of lobbying activity and no political activity. A social welfare organization status allows the organization to engage in unlimited lobbying activity to promote its social welfare goals. It may engage in some political activity as long as the political activity is not the primary activity. A political organization engages entirely in political activity.

Yes, it is a complex process to set it up. That’s why, if you feel you need our professional team to help you, let us know.

Our comprehensive approach allows our unique clients to confidently navigate the complexities of taxation as new laws are implemented into the tax code.

We focus on client satisfaction, delivering high-quality services at fair rates.

Contact us to learn more about our business & non-profit entities consulting CPAs who can help you in your overall tax planning and compliance.