IRS 2026 §199A QBI deduction thresholds and phaseouts reshape eligibility and planning strategies for LLCs, S corporations, and partnerships. Learn how these updates impact the 2026 tax year- (2027 filing season).

2026 IRS Tax Rules for LLCs, S Corps & Partnerships

Ryan Millan, CPA

Introduction: 2026 Business Tax Updates

Each year, the IRS adjusts dozens of tax parameters for inflation-brackets, deductions, credits, and phaseouts. For 2026, Revenue Procedure 2025-32 confirms that most thresholds rise by roughly 2.3 % to 3 % over 2025 levels. These updates protect purchasing power and reduce “bracket creep” as wages and prices increase.

The One Big Beautiful Bill Act (OBBBA), signed July 4, 2025, made several temporary business provisions permanent, including the § 199A Qualified Business Income (QBI) deduction and 100 % bonus depreciation. It also raised and indexed the SALT cap through 2029 and expanded SECURE 2.0 retirement plan credits for small-business owners.

Together, these changes reshape how LLCs, S corporations, and partnerships plan compensation, depreciation, and state tax elections as they enter the 2026 tax year - (2027 filing season).

For high-income earners and closely held businesses, the overall impact depends on how entity structure, deduction limits, and timing strategies interact under these new rules.

Combined, these IRS and legislative updates expand planning opportunities for business owners. The next section outlines how 2026 tax rates, QBI limits, and related provisions apply to LLCs, S corporations, and partnerships.

2026 Federal Tax Provisions for LLCs, S Corps & Partnerships

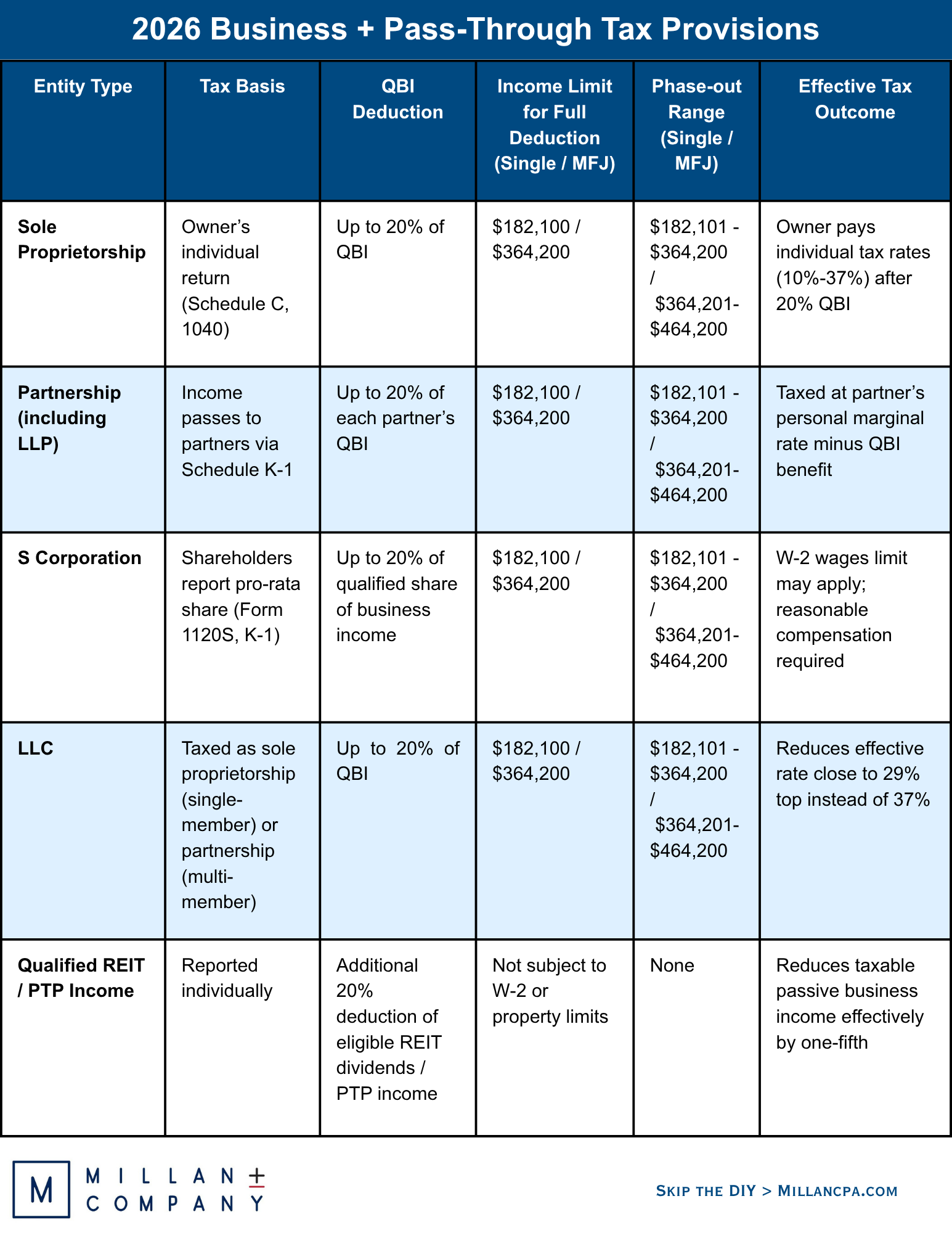

Below is a consolidated table view of 2026 federal tax considerations for LLCs, S corporations, and partnerships - including tax basis, QBI eligibility limits, phase-outs, and effective outcomes.

Sources: IRS Revenue Procedure 2025-32; OBBBA (2025); SECURE 2.0 Act of 2022. Indexed figures reflect 2–3 % inflation adjustments year over year. For individual and estate brackets, see Millan & Co.’s related 2026 Tax Guides.

Qualified Business Income (QBI) Deduction - Key Facts

The § 199A Qualified Business Income (QBI) deduction -made permanent under the 2025 One Big Beautiful Bill Act (OBBBA) - continues to allow eligible pass-through owners to deduct up to 20 % of qualified business income (QBI).

The deduction equals the lesser of:

• 20 % of QBI, or

• the greater of (a) 50 % of W-2 wages paid by the business, or (b) 25 % of W-2 wages + 2.5 % of unadjusted basis (UBIA) of qualified property.

Eligibility

Applies to sole proprietors, partnerships, S corporations, LLCs, and certain REIT or PTP investors.

State Interaction

Most states conform to the federal § 199A rules, but several—such as California, New Jersey, and Pennsylvania—do not.

Verify your state’s treatment before finalizing projections or making SALT/PTET elections.

Specified Service Trades or Businesses (SSTBs)

Professions such as law, accounting, consulting, medicine, and financial services begin to lose the deduction once taxable income exceeds roughly $203,000 (single) or $406,000 (married filing jointly) for 2026.

Phase-out thresholds remain indexed annually for inflation.

Entity & Rate Considerations

Pass-through owners retain flexibility to adjust compensation, distributions, and capital structure for optimal tax efficiency under the 2026 framework.

C corporations remain taxed separately at a flat 21 % corporate rate and are not eligible for the QBI deduction.

CPA Note: Now that the QBI deduction has been made permanent, owners of pass-through entities should model multi-year strategies that coordinate reasonable compensation, depreciation timing, and elective SALT/PTET planning to sustain the full 20 % benefit over time.

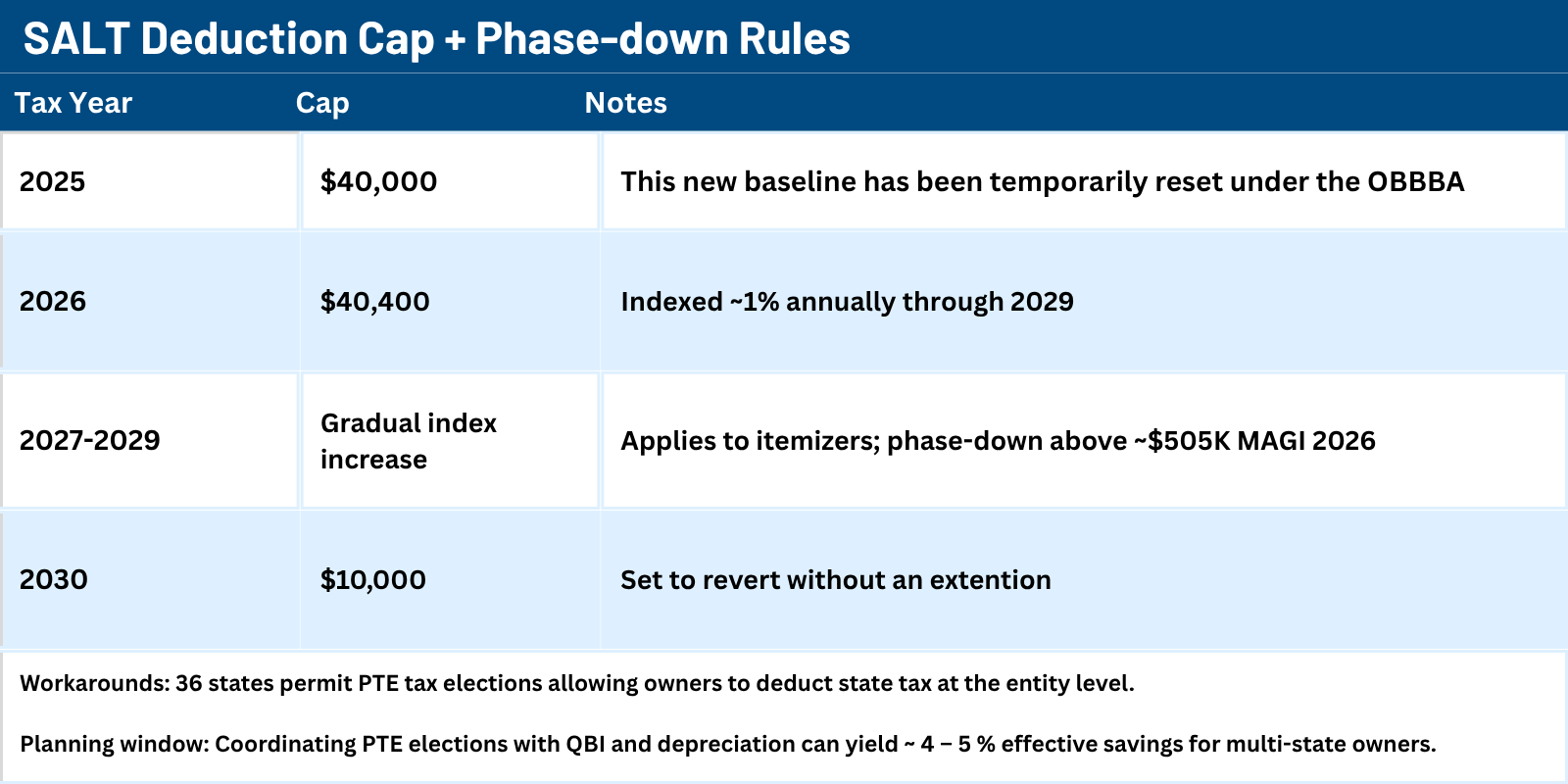

SALT Deduction Cap + Phase-down Rules ( Yearly Provision Comparisons)

The SALT deduction cap, reset under the OBBBA, increases to $40,000 in 2025 and about $40,400 in 2026. Indexed through 2029, it phases down for taxpayers above roughly $505,000 of MAGI (2026). Unless extended, the cap reverts to $10,000 in 2030.

CPA Note: 36 states permit PTE taxes so owners can deduct state income tax at the entity level. Coordinating PTE elections with QBI and depreciation can yield a 4–5% effective savings for multi-state owners.

2026 Long-Term Capital Gains Rates for Business Owners

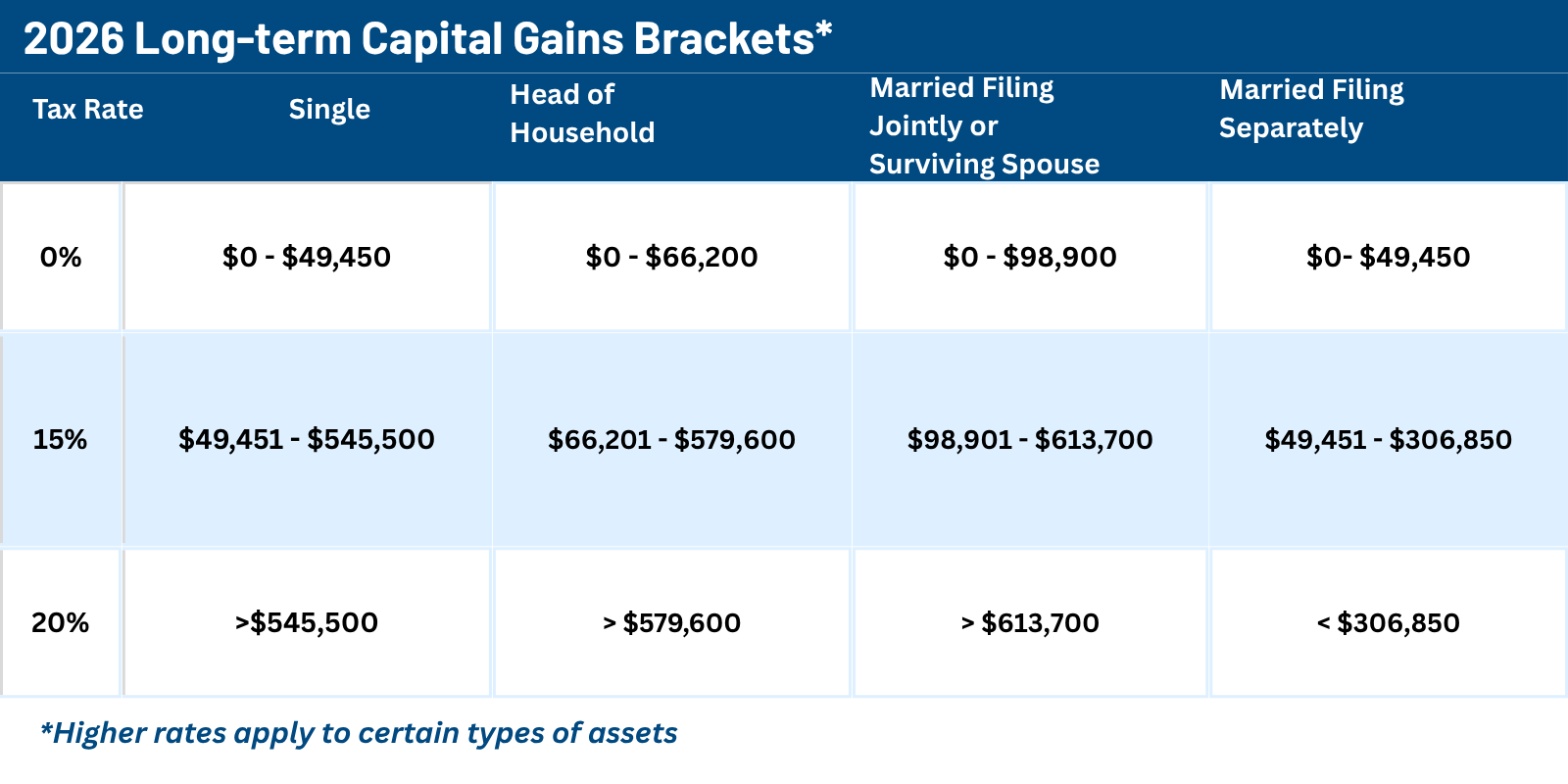

Long-term capital gains brackets adjust slightly for inflation under IRS Revenue Procedure 2025-32, preserving the familiar 0 %, 15 %, and 20 % rate structure for 2026.

The same thresholds apply to qualified dividends, maintaining preferential treatment for long-term investors and business owners realizing gains from appreciated assets or equity holdings.

2026 Alternative Minimum Tax (AMT) Thresholds

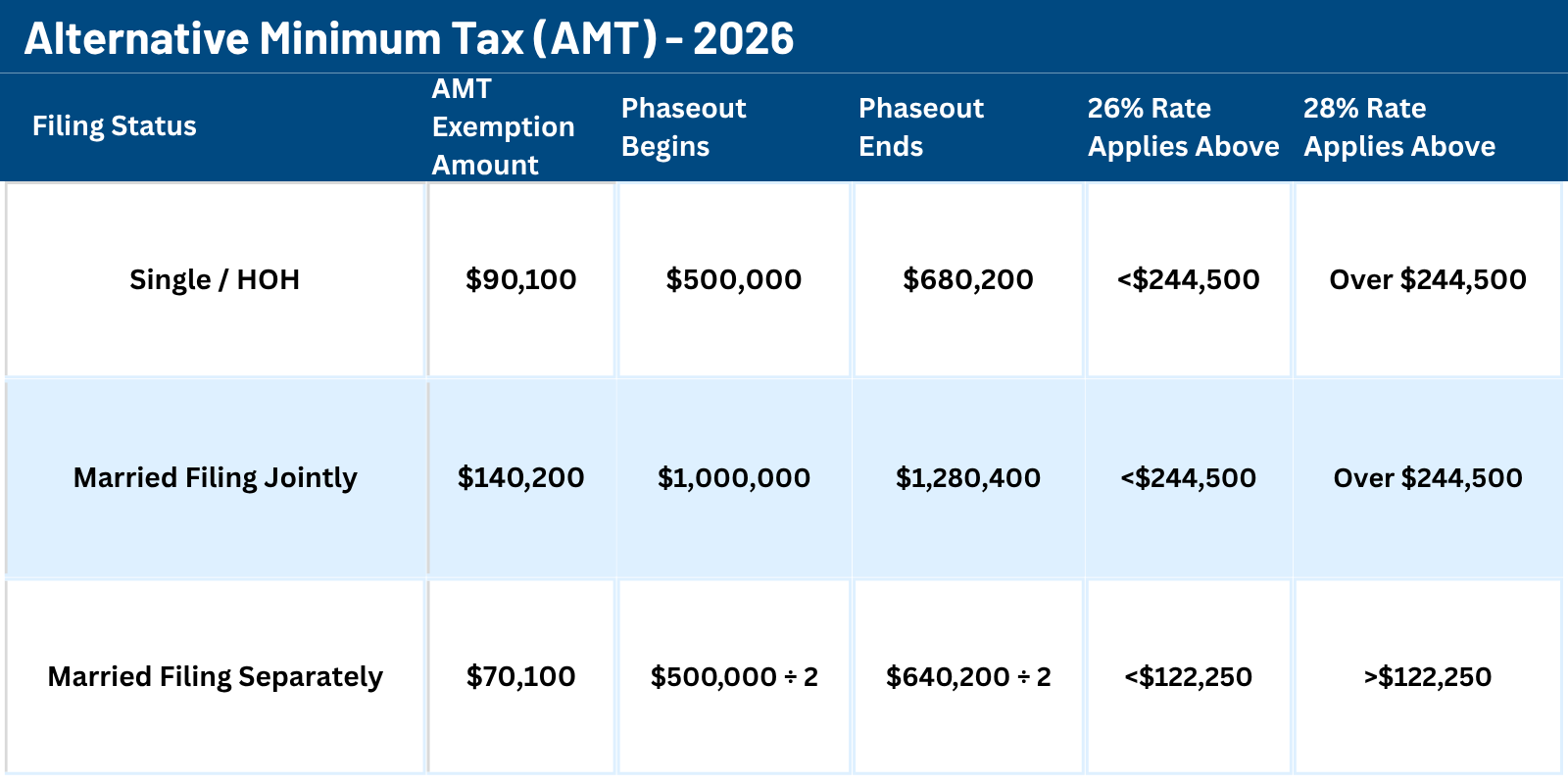

AMT exemptions and phase-out thresholds increase again under IRS Rev. Proc. 2025-32, helping more taxpayers avoid exposure to the alternative minimum tax.

While AMT primarily affects higher-income individuals, it remains relevant for owners of pass-through entities who exercise stock options, claim accelerated depreciation, or generate substantial preference items.

Source: IRS Rev. Proc. 2025-32;Sec. 3.19. 2026 AMT exemption and phase-out levels based on inflation adjustments. For individual AMT analysis, see Millan & Company’s 2026 IRS Individual Tax Brackets article

Highlights + Planning Considerations

§ 199A QBI Deduction Phase-ins

The § 199A Qualified Business Income (QBI) deduction remains at 20 %, but the 2026 inflation adjustments raise the income thresholds to approximately $203,000 for single filers and $406,000 for joint filers.

Owners of service-based trades—such as law, consulting, accounting, medicine, and financial services—should monitor these limits closely to preserve partial eligibility as income approaches the phase-out range.

§ 179 Expensing and Bonus Depreciation

The § 179 expensing limit increases to about $1.32 million, with a phase-out beginning after $3.29 million of qualifying purchases.

Bonus depreciation continues its scheduled reduction to 60 % for property placed in service during 2026.

Businesses planning major equipment or software investments should coordinate timing to maximize remaining expensing flexibility under both provisions.

Entity-Choice Review

With corporate tax rates holding at 21 %, some LLCs and S corporations may reconsider whether a C-corporation structure produces better after-tax cash flow once the TCJA sunsets are fully harmonized.

Scenario modeling with a CPA can identify potential 2026–2027 restructuring opportunities and help evaluate pass-through versus C-corp advantages under the new QBI and SALT frameworks.

R&D Capitalization Rules

Domestic research expenses must still be amortized over 5 years (15 years for foreign research).

The OBBBA retained this structure but extended certain R&D credit offsets.

Accurately tracking qualified-research wages and software development costs remains critical for estimated-tax planning and credit utilization.

Clean-Energy and Manufacturing Credits

Inflation-indexed incentives -including § 45L (Energy-Efficient Home Credit), § 45X (Advanced Manufacturing Credit), and § 48C (Investment Tax Credit)—continue through 2026.

Taxpayers should coordinate credit stacking with overall tax capacity to avoid losing benefits to carry-forward limitations or overlapping credit restrictions.

CPA Note:

Most business owners will benefit from aligning year-end capital purchases, retirement contributions, and owner-salary allocations to leverage 2026’s higher thresholds and depreciation rules.

Regularly reviewing estimated tax payments helps avoid underpayment penalties as limits and phase-outs shift under the new inflation adjustments.

Business & Pass-through FAQs

Q: What is the 2026 § 199A (QBI) threshold?

A: Roughly $203,000 for single filers and $406,000 for joint filers (MFJ).

Above these levels, service-business limitations phase in, potentially reducing the 20 % deduction. Plan W-2 wages and qualified property (UBIA) carefully to maintain eligibility.

Q: What happens to bonus depreciation in 2026?

A: Bonus depreciation steps down to 60 % for qualified property placed in service during 2026, as scheduled under the One Big Beautiful Bill Act (OBBBA).

Businesses planning equipment or software purchases should consider accelerating acquisitions before year-end to capture a higher deduction.

Q: Has the § 179 expensing limit changed?

A: Yes. For 2026, the § 179 expensing limit increases to about $1.32 million, with a phase-out beginning at $3.29 million of qualifying property.

Many businesses combine § 179 with bonus depreciation for maximum first-year write-offs and cash-flow flexibility.

Q: Are there any changes to the corporate rate?

A: No. The corporate rate remains a flat 21 %.

However, owners should re-evaluate entity structure as TCJA sunsets approach, since future rate adjustments could alter pass-through vs. C-corporation efficiency.

Q: How does the SECURE 2.0 Act affect business owners in 2026?

A: SECURE 2.0 expands small-business retirement incentives, increasing startup plan credits, allowing Roth employer contributions, and extending catch-up options for older owners.

These provisions can reduce taxable income, strengthen QBI eligibility, and align with 2026 compensation and entity-planning strategies.

Q: What should small-business owners do before filing for 2026?

A: Review depreciation schedules, QBI eligibility, and retirement-plan funding, then model estimated tax payments using the new inflation-adjusted thresholds.

Coordinating these updates with your CPA helps ensure deductions and cash-flow timing align under the 2026 framework.

These frequently asked questions address the most common 2026 business-tax updates.

For owners and advisors looking to take the next step, the following section explains how to apply these updated pass-through and business tax rules within practical planning strategies—covering income modeling, depreciation timing, and elective state considerations.

Applying the 2026 Pass-through and Business Tax Rules

The 2026 tax adjustments create both opportunity and complexity. Business owners should treat these changes not as a one-year event, but as a multi-year planning framework that shapes cash flow, compensation, and entity strategy through at least 2029.

Establish 2026 as Your Baseline Year

Use 2026 as the modeling year for projections. With § 199A (QBI), § 179, and bonus depreciation thresholds now inflation-indexed, accurate planning depends on reviewing:

Business income to expected growth and bracket movement,

W-2 wages to QBI optimization limits, and

Qualified property (UBIA) levels to future phase-ins.

This baseline helps you identify when deductions, compensation, or purchases may trigger or reduce phase-outs in later years.

Revisit State-Level SALT and PTET Planning

State conformity remains uneven. The SALT cap is indexed through 2029, while elective PTET regimes differ in timing and credit treatment.

Coordinating these state elections with federal deductions can materially change your net effective tax rate -particularly for multi-state pass-through entities.

Model both entity-level and owner-level outcomes before making elections or quarterly estimated payments.

Evaluate Balance-Sheet and Cash-Flow Timing

Timing matters more in a multi-year framework. Large asset purchases, retirement-plan funding, or debt restructuring can shift deductible amounts between years.

In some cases, deferring a deduction or leveling income over two tax years may produce a stronger overall QBI benefit than front-loading expenses in 2026.

Coordinate with your CPA before year-end to ensure depreciation schedules, contributions, and distributions align with your cash-flow strategy.

Treat 2026 as a Strategic Checkpoint

The permanence of § 199A QBI and 100 % bonus depreciation under the One Big Beautiful Bill Act (OBBBA) stabilizes many key provisions, but the broader landscape-SALT caps, R&D amortization, and SECURE 2.0 incentives -continues to evolve.

Reassess projections each year through 2029 to capture benefits as phase-ins and thresholds shift.

Working with your CPA to integrate these federal, state, and entity-level variables will help your business capture the full benefit of the 2026 reforms while maintaining flexibility for future adjustments.

Summary

The 2026 tax year brings measured but meaningful adjustments for business owners and entrepreneurs. Under the One Big Beautiful Bill Act (OBBBA), updates to §199A, §179, bonus depreciation, and the SALT framework collectively extend key advantages for proactive taxpayers.

Understanding how these provisions interact with your income level, entity structure, and long-term growth objectives is essential to maintaining tax efficiency through the next reform cycle.

Strategic modeling across QBI, depreciation timing, and elective SALT planning can help ensure your business remains aligned with both federal and state opportunities heading into the 2027 filing season.

Let’s Plan Your 2026 Strategy

Every business and taxpayer faces a unique set of challenges and opportunities.

Schedule a personalized planning session with Millan & Co. CPAs to align your income, deductions, and entity structure with the 2026 thresholds.

Our firm’s mission is to simplify complex tax matters while delivering the highest level of client service and insight.

Your journey toward financial clarity starts with a conversation.

Contact us today to explore how proactive planning can enhance your after-tax results for 2026 and beyond.