"One Big Beautiful Bill Act": Official Tax Policy - Key Provisions

Ryan Millan, CPA

Executive Summary

The "One Big Beautiful Bill Act" was signed into law on July 4th, 2025 after narrowly passing Congress. The new legislation includes a broad range of temporary and permanent tax cuts for individuals, estates, businesses and international entities.

This article focuses specifically on the new tax provisions and rates, excluding coverage of the various program funding measures which have also been signed into law.

Enactment dates for the changes vary from retroactive to immediate, with many expiring in 2028 and 2029. Details are outlined below.

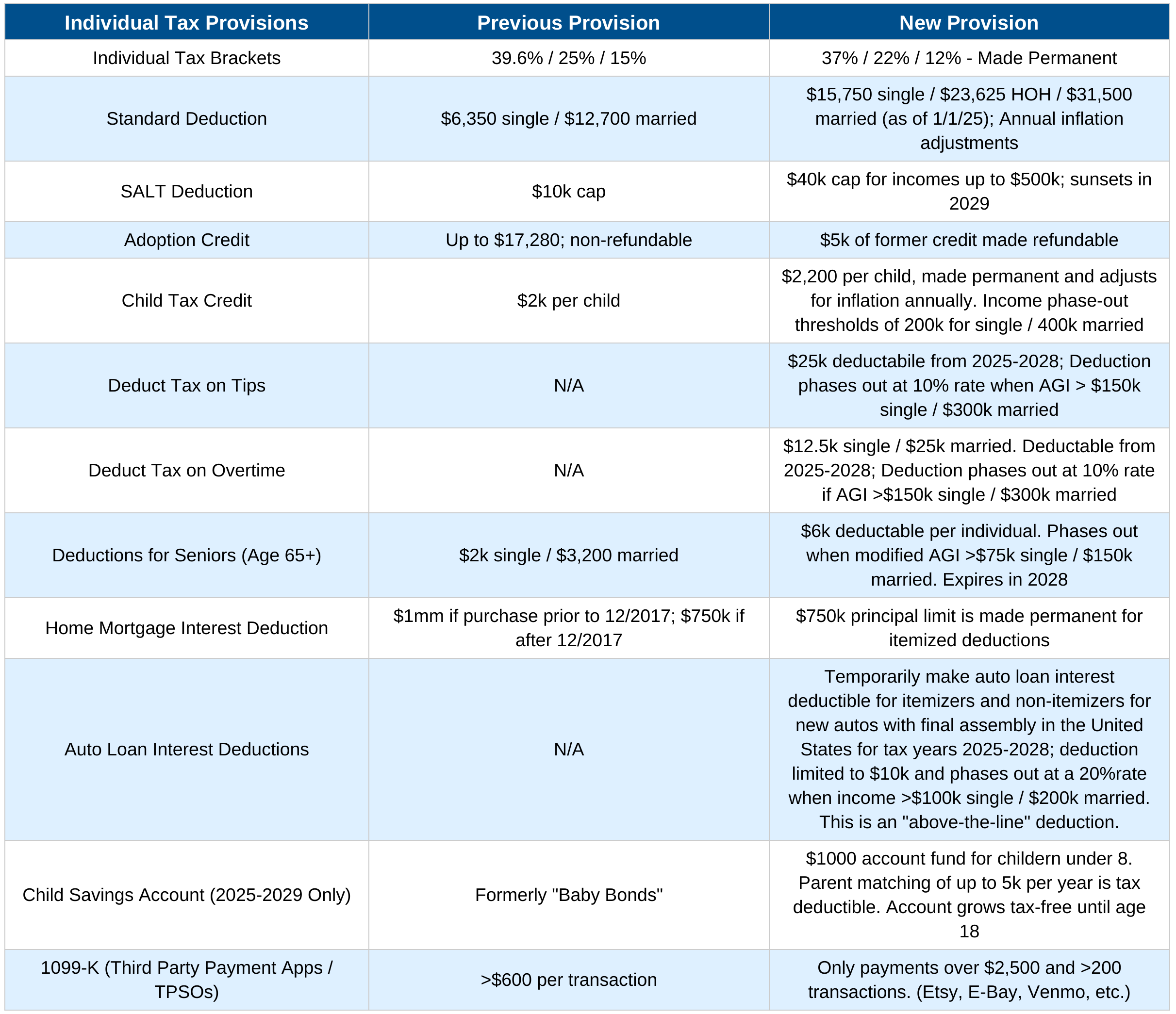

Individual Tax Provisions

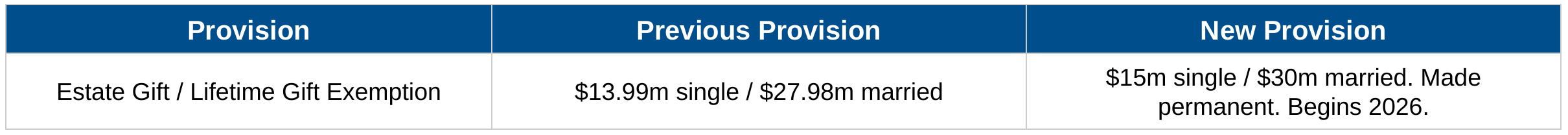

Estate Tax Provisions

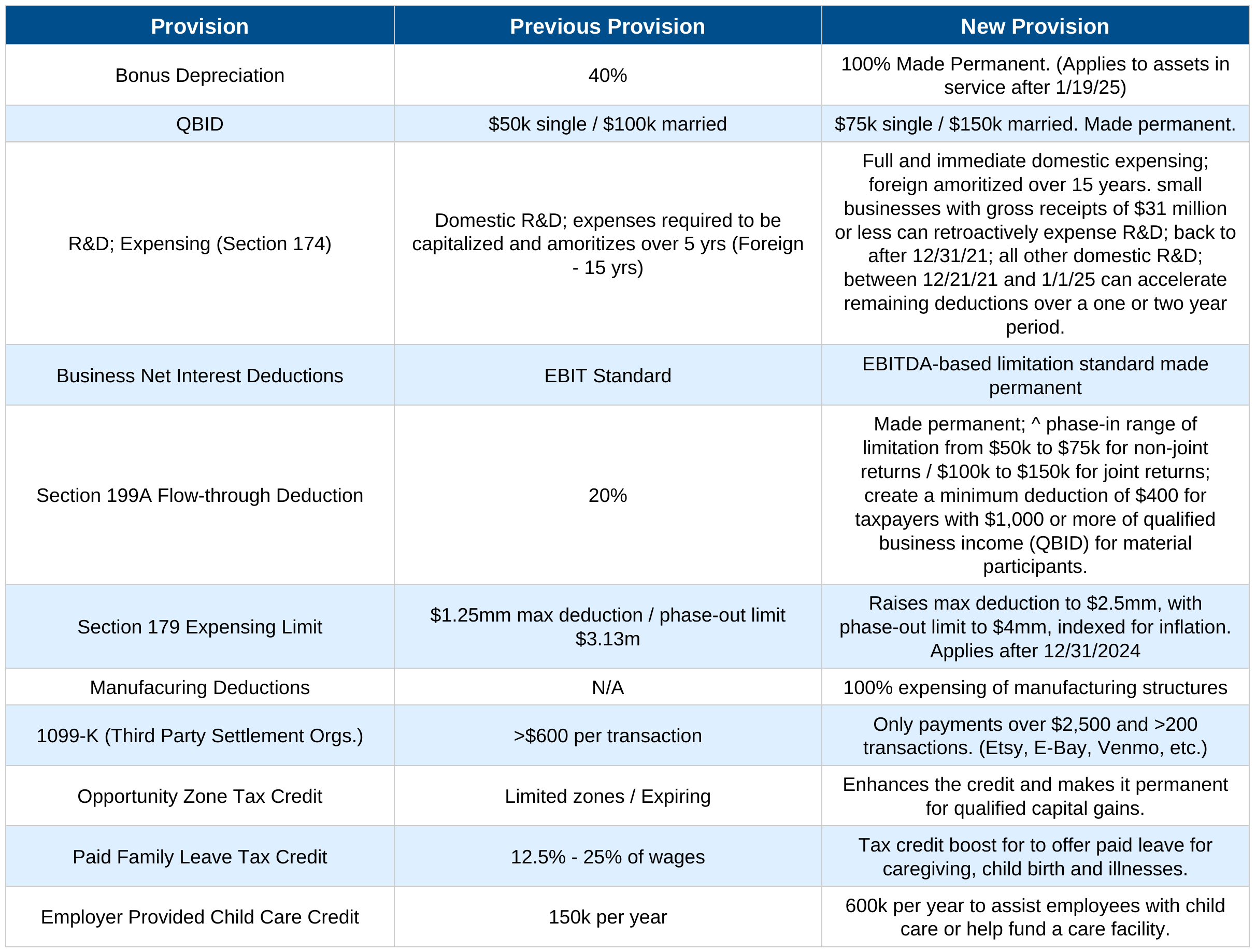

Business Tax Provisions

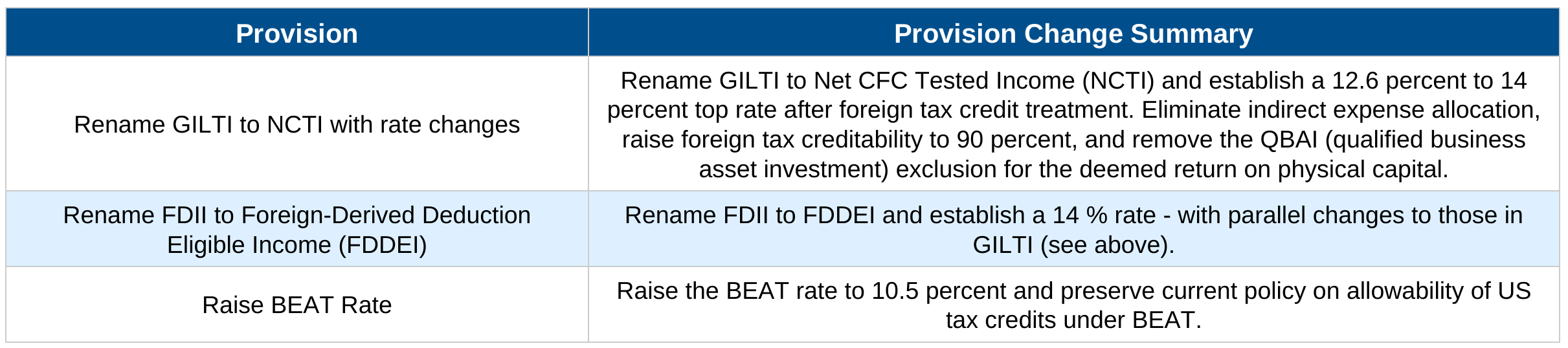

International Tax Provisions

Notes on International Changes

- Permanently reduce the post-2025 global intangible low taxed income (GILTI) inclusion rate from 62.5 percent to 50.8 percent, increase the foreign-derived intangible income (FDII) deduction from 21.875 percent to 36.5 percent, and reduce the base erosion and anti-abuse tax (BEAT) rate from 12.5 percent to 10.1 percent.

- Please contact us with related International Accounting related questions, including BEAT policy changes and preserving the current policy on allowability of US tax credits under BEAT.

Key Takeaways

While the provisions within this legislation complicate the tax code with their various enactment and expiration dates, "stackable" or "above-the-line" deductions and phase out thresholds; when combined properly, they can offer significant reductions in your overall tax liability and gains in your strategic tax planning efficacy.

We're here to help solve complex individual and business tax matters and explore what's possible with your unique set of goals and circumstances.

Contact us today to learn how we can work with you.