Updated Reporting Rules for Form 1099 K Under the One Big Beautiful Bill Act

Form 1099-K Changes for 2025: What Businesses and Sellers Must Know

Ryan Millan, CPA

Overview

The reporting requirements for Form 1099-K (Payment Card and Third Party Settlement Organizations) are changing again for the 2025 tax year.

Under the One Big Beautiful Bill Act (OBBBA), the IRS has reinstated the longstanding threshold for third party settlement organizations (TPSOs): more than $20,000 in gross payments and more than 200 transactions per platform.

This guide explains the updated rules with examples, clarifies when a Form 1099-K must be issued, and addresses commonly asked questions.

Key 1099-K Rules for 2025

A TPSO must issue a Form 1099-K only when both conditions are satisfied. More than $20,000 in gross payments and more than 200 transactions within a single platform.

The threshold applies per TPSO. Payments across multiple platforms are not combined.

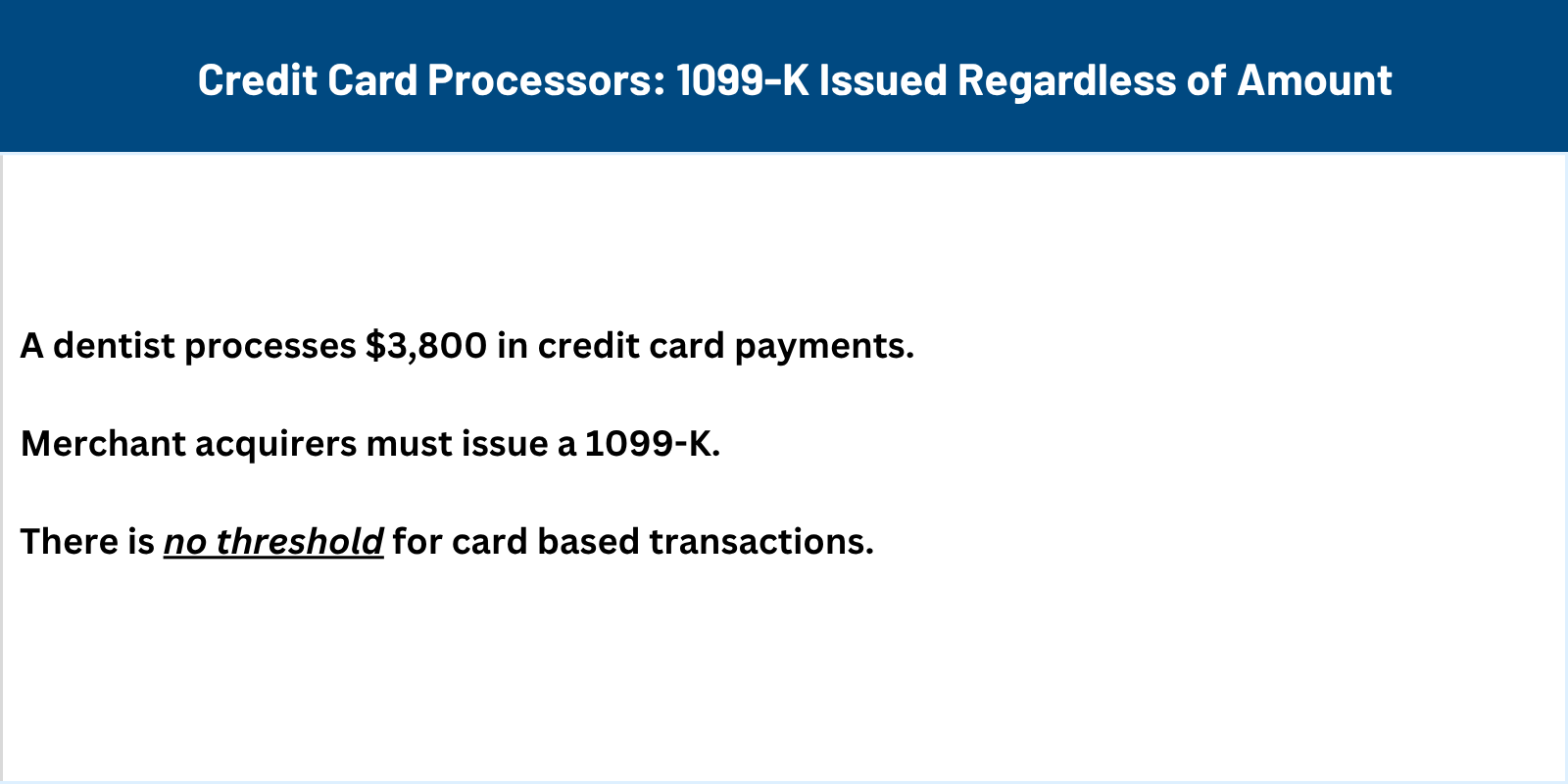

There is no threshold for payment card transactions. Merchant acquirers must issue a 1099 K regardless of dollar amount.

1099 K reporting uses gross payments, not amounts net of processing fees or refunds.

Personal transfers that do not involve goods or services are not reportable.

Some states impose different or lower reporting requirements.

State Level Reporting Considerations - Including Texas

State level 1099-K rules vary significantly and may impose obligations that differ from the federal threshold. While the federal standard requires more than $20,000 and more than 200 transactions per TPSO, many states set lower thresholds or require separate state filings.

What to know:

Texas does not require businesses or TPSOs to file a separate state Form 1099-K because Texas does not impose a personal income tax. However, this does not relieve Texas taxpayers or platforms from federal 1099 K requirements.

Businesses operating in multiple states should confirm whether each state requires separate reporting. Several states have historically imposed thresholds far lower than the federal rule.

Many payment platforms automatically handle state filings for you, but practitioners should never assume this. Always verify state level responsibilities for multistate clients.

CPA Note:

Businesses with cross border or multistate activity should incorporate a state level 1099-K check into year end workflows and onboarding processes.

Reference: Texas information return overview: https://www.tax1099.com/state-filing/texas-1099-filing-requirements

Examples of When a Form 1099-K Is (or Not) Required for 2025

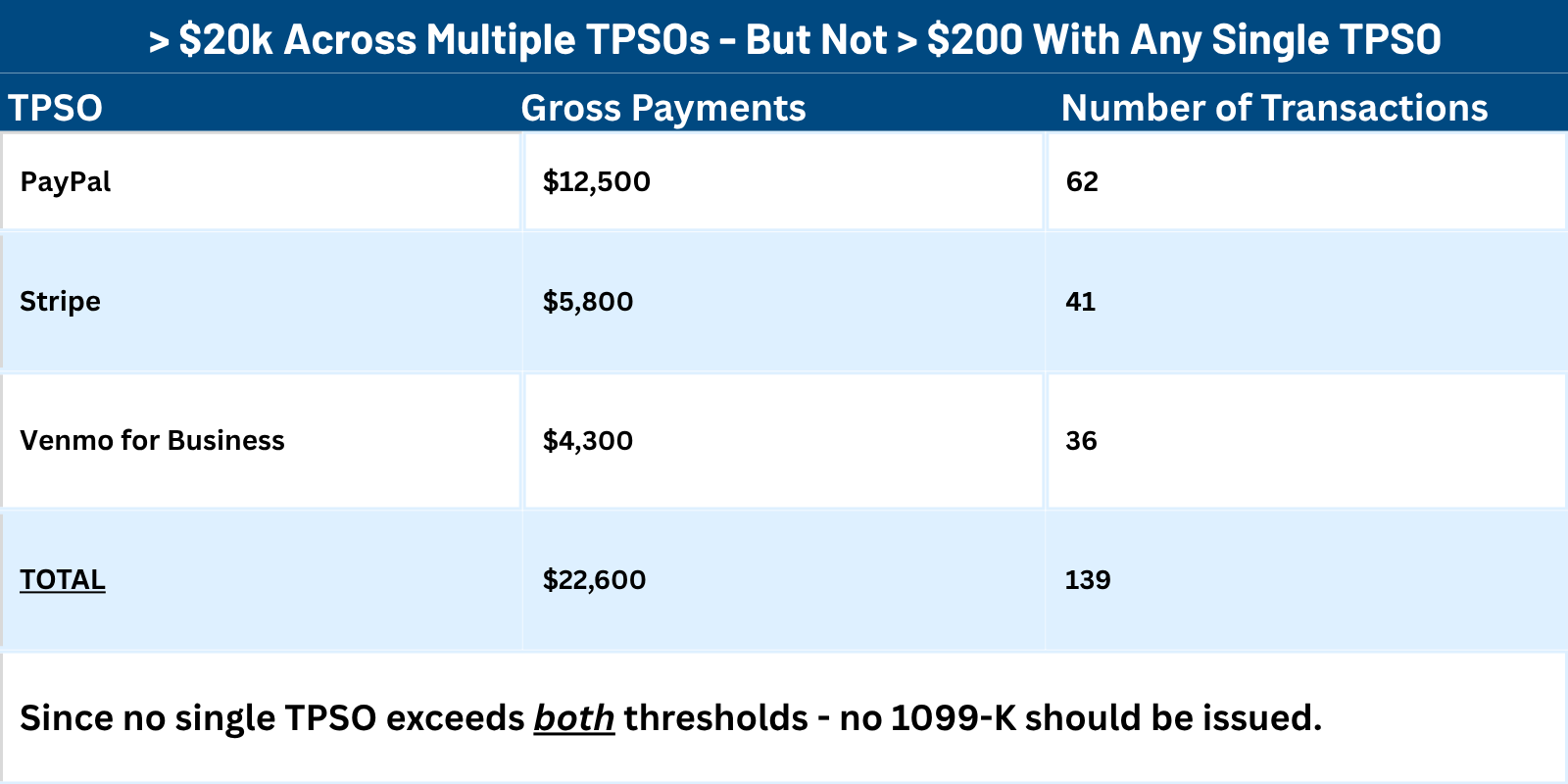

Example 1

When more than $20,000 across multiple TPSOs - but no single TPSO exceeds both thresholds

A consultant uses PayPal, Stripe and Venmo for Business.

Since no single TPSO exceeds both thresholds, no 1099 K should be issued by any of the individual TPSOs.

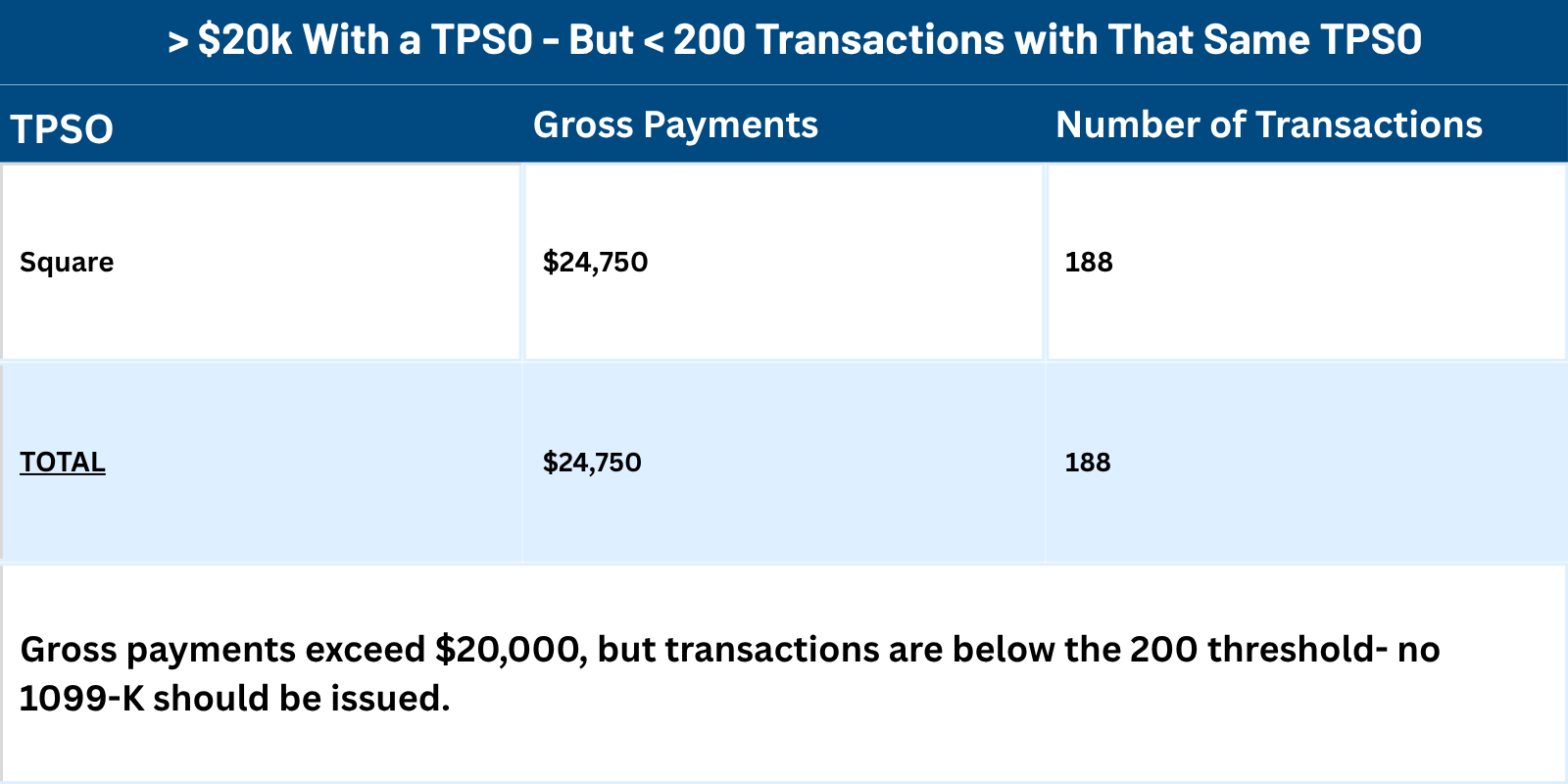

Example 2

More than $20,000 with one TPSO but fewer than 200 transactions

Gross payments exceed $20,000, but transactions do not exceed 200.

No 1099 K is issued.

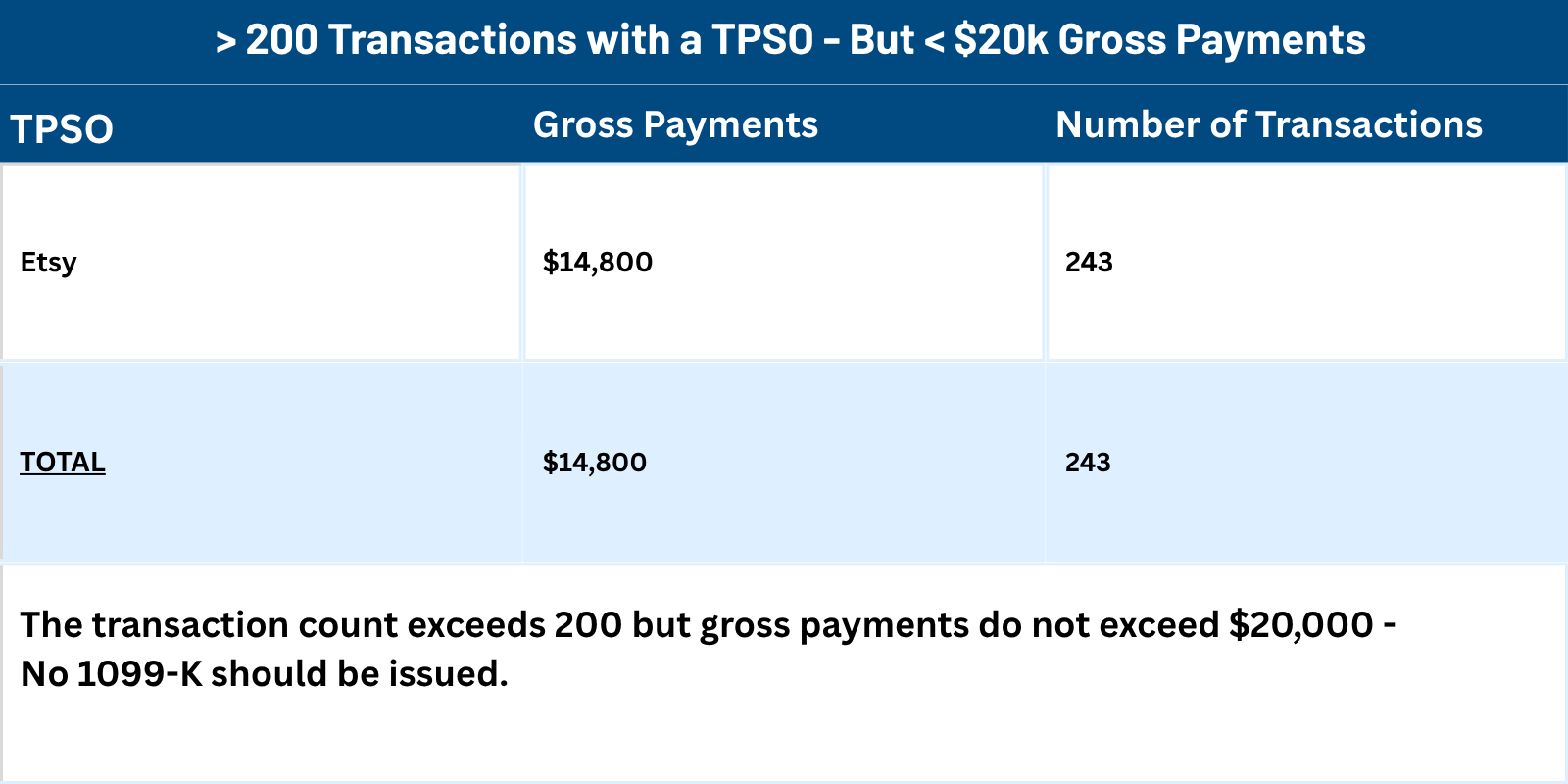

Example 3

The transaction count exceeds 200 but gross payments do not exceed $20,000.

No 1099 K should be is issued.

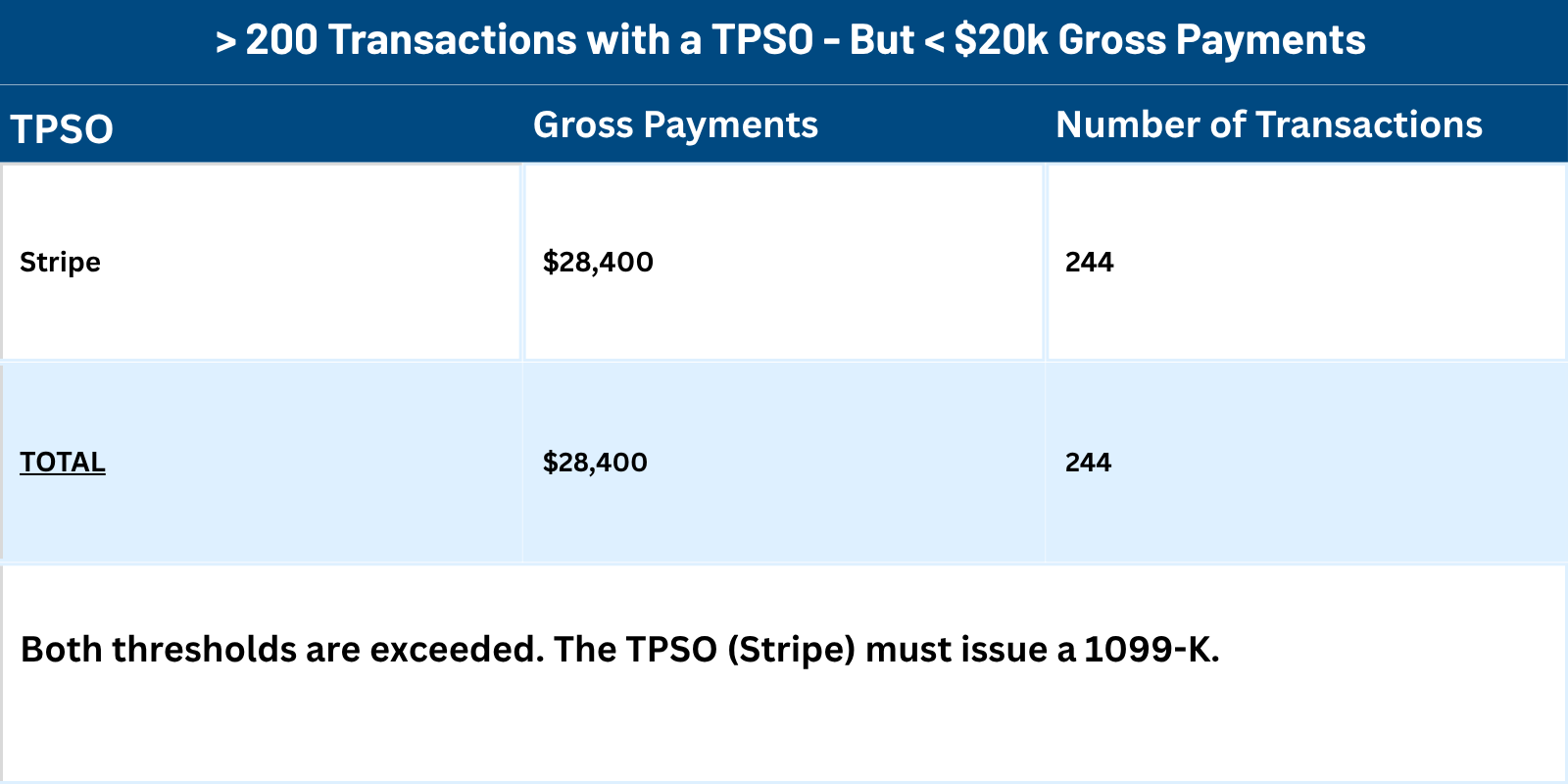

Example 4

One TPSO exceeds both thresholds

A 1099 K should be issued.

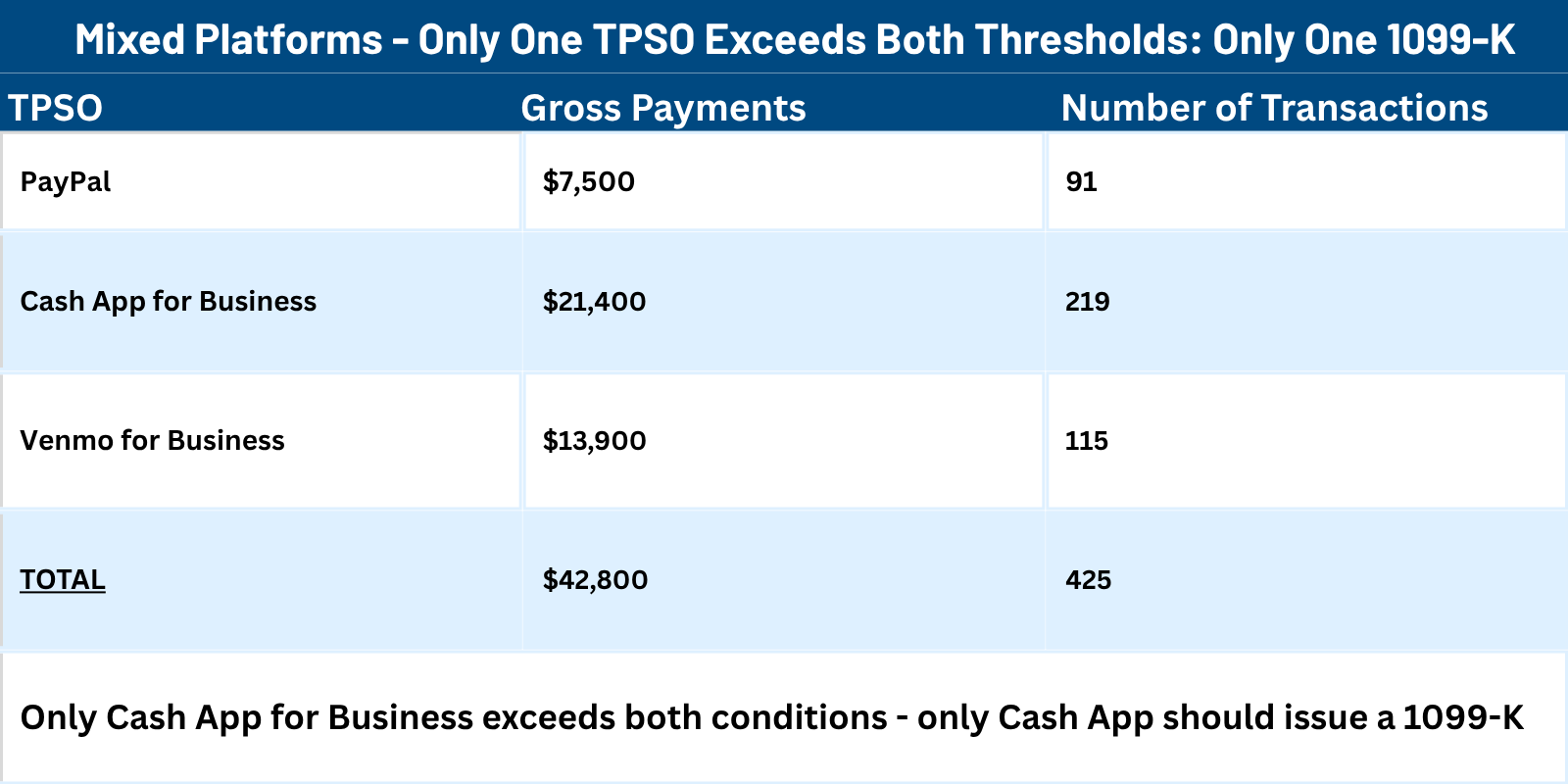

Example 5

Mixed platforms where only one TPSO exceeds both thresholds

Only the Cash App for Business TPSO should issue a 1099-K.

Example 5

Personal Reimbursements

Example 7

Credit Card Processors

2025 Form 1099-K: FAQs

What is the Form 1099-K threshold for the 2025 tax year?

The IRS reinstated the longstanding threshold. A Form 1099-K is required only when a payee receives more than $20,000 in gross payments and more than 200 transactions from a single TPSO in 2025.

Do the 1099-K thresholds combine across platforms?

No. The thresholds apply per platform. Payments across PayPal, Square, Stripe, Venmo for Business, etc., are not combined. Only the TPSO that individually exceeds both thresholds must issue a form.

Are personal payments or reimbursements reportable?

No. Personal reimbursements or cost-sharing payments (such as splitting rent or utilities) are not reportable because they do not involve goods or services.

Why did I receive a 1099-K for a very small amount?

This typically happens with payment card transactions, which have no threshold. Merchant processors must issue a Form 1099-K for any amount processed via credit or debit card.

What amount appears on a Form 1099-K: gross or net?

The IRS requires reporting of gross payments. Processing fees, chargebacks and platform refunds are not subtracted.

What happens if I do not receive a 1099-K but earned taxable income?

You must still report income for goods or services. The IRS notes that taxability does not depend on receiving a Form 1099-K. A missing form does not eliminate the obligation to report income.

Does Texas have its own 1099-K reporting requirement?

No. Texas does not require separate state reporting because it has no personal income tax.

However, all Texas-based businesses and sellers must still follow federal 1099-K rules, and multistate businesses should check other states’ requirements.

Are payments through Cash App, Venmo or PayPal always considered business income?

No. Only payments categorized by the platform as goods or services are considered reportable. Personal transfers marked correctly are not subject to 1099-K reporting.

Do credit card payments have a threshold?

No. Merchant acquirers must issue a Form 1099-K regardless of the dollar amount if the transaction is made via a payment card.

Will the 1099-K thresholds change again?

There is no sunset provision for the reinstated $20,000 and 200-transaction rule.

These rules remain in effect until Congress passes new legislation or the IRS issues updated guidance.

Practical Steps for Businesses and Preparers

To prepare for filing season:

Track gross payments and transaction counts per platform.

Confirm whether a client operates in multiple states with lower thresholds.

Review classifications of goods or services versus personal transfers.

Prepare clients for variances between gross platform totals and their net accounting amounts.

Update year end checklists, organizer questions and engagement letters.

Why These Rules Matter

These reinstated thresholds reduce the number of unnecessary information returns but increase the risk of inconsistency between taxpayer books and platform reporting. Taxpayers often forget that income is taxable even without a 1099 K, and mismatches are a common source of IRS notices.

Advisors who understand the new threshold rules can help clients reduce audit risk and improve documentation for 2025 and beyond.

Expert Tax Guidance for 2025 and Beyond

Whether you operate a business, manage several income streams across multiple states or oversee family office activities, accurate reporting under the 2025 1099 K rules is essential. Millan and Company CPAs provides strategic tax planning and full charge bookkeeping for high complexity financial environments.

Connect with our team to ensure your reporting remains accurate, timely and compliant.

Millan + Co., CPAs - Related Resources

Sources

IRS Form 1099 K FAQ: https://www.irs.gov/newsroom/form-1099-k-faqs

IRS Fact Sheet FS 2025 08: https://www.irs.gov/pub/taxpros/fs-2025-08.pdf

IRS Information Returns Announcement: https://www.irs.gov/newsroom/irs-announces-no-changes-to-individual-information-returns-or-withholding-tables-for-2025-under-the-one-big-beautiful-bill-act

Texas Filing Overview: https://www.tax1099.com/state-filing/texas-1099-filing-requirements