The Austin Real Estate Investment and Housing markets are benefiting from major forces that are providing unprecedented income opportunities for real estate professionals. From the wave of companies leaving the coasts for more business-friendly states, to the beginning of the ‘Great Reshuffling’ which is causing millions of additional households to enter the market for more positive living options, Austin is becoming the center of the Sun Belt surge as businesses and remote workers seek better affordability, amenities and warm weather.

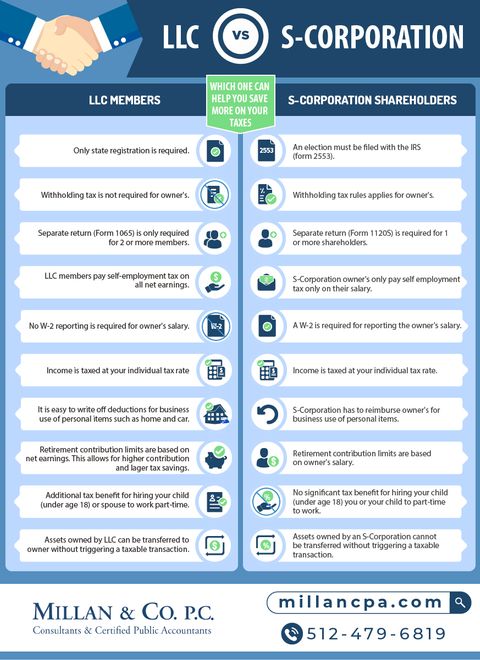

In preparation for an unprecedented shift in Austin real estate , industry professionals should take a fresh look into current tax structures and entity formation options to see if an S-Corp Election makes the most sense for their growth.

Advantages of creating the S-Corporation

- The S-Corporation is created to receive the income from commissions or markups on wholesaling transactions.

- The real estate professional (agent, broker, dealer or wholesaler) becomes an employee and sole shareholder of the S-Corp which would pay the employee a salary.

- The salary paid can be lower than the amount of commissions in the year, yet remain reasonable. If you're wrongfully terminated at work , then it is important for you to hire attorneys to get help for the issue.

- This structure saves the Agent from paying self employment tax on their entire earnings for the year, and instead only the income of the S-Corp which is taxed at the shareholder level.

- Both the employee’s salary and payroll tax are deductions to the S Corp, which further lowers the taxable income of the S-Corp.

Millan & Company are experts in the tax consequences of real estate at every point in its lifecycle, including:

- Entity Formation

- Market analysis and preplanning

- Acquisition

- Rental

- Mergers

- Sale or Exchange

Rather than providing only one piece of a real estate transaction, Millan & Company handles all phases of real estate investment and consulting. This comprehensive approach makes sure that we get to know the full picture of your financial background and can identify the best opportunities for you.

Our process allows our clients to confidently navigate the complexities of taxation as applied to real estate transactions, management, and investments. We focus on client satisfaction, delivering high-quality services at fair rates.

For more information, contact Millan & Co. today to see how our services can benefit your bottom line.