Selling a Single-Family Home Amid Higher Interest Rates

Millan + Co | Austin CPAs and Consulatants

In the current high interest rate real estate housing market, median home price points, new listings and pending transactions have fallen considerably, while inventory is increasing significantly. These higher mortgage rates can make a new home purchase less affordable despite the appeal of lower pricing. Many need to move based on work opportunities while others need to adjust for a myriad of changing life requirements, not to mention achieving longer-term investment goals.

What are the best factors and trade-offs to evaluate in the consideration of a housing purchase in the current market? Assessing your real estate assets within the scope of your broader financial circumstances and personal investment plan could help create a sound strategy.

A balanced approach assesses both tax and cash flow impact as it relates to the role of your current house and how that best impacts the acquisition of a new home.

Residential Housing Market Conditions

National trends and echoed in Austin, TX:

Higher interest rates

Increasing inventory

Lower prices and potential deals

Higher Interest Rates

Mortgage interest rates have seen a steep climb over the past 20 months. The rate increases have affected both adjustable and fixed mortgage loan products and impacted the spectrum of mortgage term options as well - 7, 10, 15, or 30 years.

Increasing Inventory

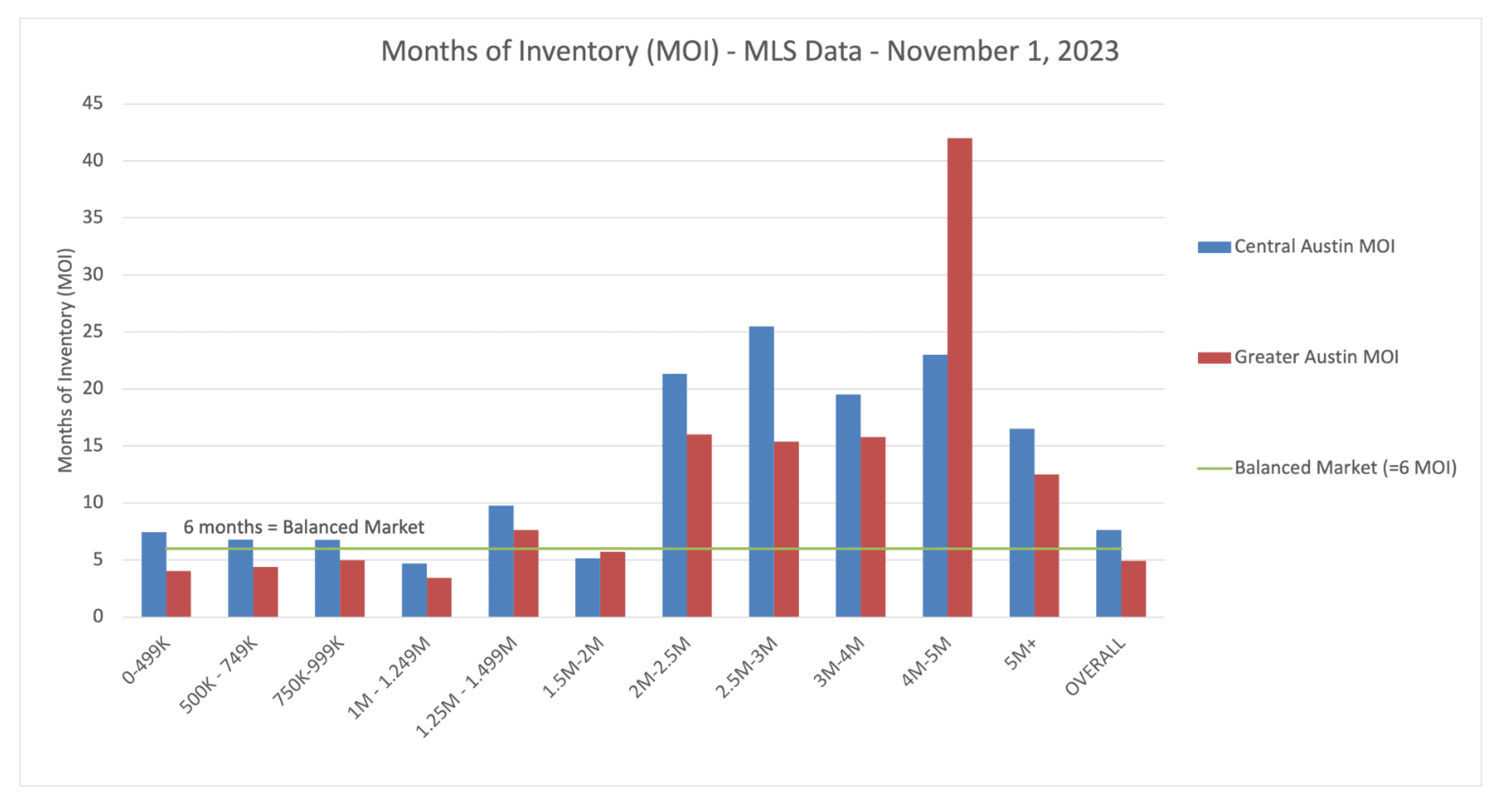

Despite fewer homes coming on the market where homeowners are locked into lower interest rates, slower sales activity is beginning to lead to inventory increases. Months of inventory (MOI), particularly at higher price points, is increasing significantly. In some areas that experienced the highest increases in real estate prices, like Austin, TX, price points over 2M are, overall, showing ~ 1.5 years of inventory.

New home builders continue to add supply which also increases the MOI. The higher inventory should be having some effect on lowering prices soon, provide opportunities to help mitigate the higher rate environment and bring buyers back to the market.

Areas of Opportunity

If buyers can manage the financial risks, it could be a good time to capitalize on flat-to-falling prices in order to upgrade your residence or relocate to take advantage of career opportunities. Property owners should fully analyze all options involved in the decision- the sell vs. rent and buy components.

Example:

A buyer owns a three-bedroom house with a 30-year fixed rate mortgage at 3% could sell for $1.5 million, netting a gain of $300,000 before considering if the gain would qualify for exclusion. The buyer wants to upgrade to a four-bedroom.

A suitable property with a motivated seller is available for $2 million. If we also assume the buyer has good credit and $5 million in taxable investments including stock, what questions should they ask before deciding? Let’s look at a few potential scenarios for how this could play out below and the subsequent risks that should be considered.

Sell Now and Purchase with a Mortgage Scenario

The traditional approach in a normal housing and interest rate environment might be to sell the current home and buy the new home, taking out a new mortgage. A buyer who owns a home and used it as a primary residence for at least two years of the previous five years could exclude up to $500,000 of gain from their federal income taxes for a married taxpayer.

This would make the sale federal income tax free, given the above assumptions. Since the new mortgage rate would be much higher, the monthly mortgage payment would increase significantly.

This might be worth it if the new home is selling at a nice discount from normal market conditions. The sale of the old house might not sell for as much as hoped for, but since the new house is more expensive, the purchase discount could exceed the sales discount.

Sell Now and Purchase with Cash Scenario

The person in the scenario above could sell their current home and some stock to pay cash for the new one. They may be able to avoid tax on the sale of the home if they qualify to exclude the gain under Section 121 of the Internal Revenue Code. Similarly, taxes may be owed if there’s a taxable gain in the stock position sold, so they may look to sell stock that hasn’t appreciated or offset the gain with losses from other investments.

The homeowner could explore non-mortgage short-term financing options to pay in cash.

Rent Now and Purchase with Cash Scenario

Going back to the original scenario, assume the homeowner wants a new home at a good price but doesn’t want to sell the current home at a discount.

They could rent out the existing home at least until the market recovers. To qualify for up to $500,000 of federal income tax-free gain on the sale of the property, sell within three years of moving out.

At the time of sale, the homeowner owned the property and used it as a primary residence for two of the past five years. Keeping it longer than the three years would lose the primary residence gain exclusion, but they could still potentially exchange the rental for other business property to help avoid those taxes.

Possible Impacts and Risks

Each homeowner will have a different set of facts and circumstances to work through. The following are some questions to consider in partnership with a personal financial planner and real estate agent.

How Real Estate Holdings Affect a Long-Term Financial Plan

Are there liquid funds?

What target return on investment do the long-term financial goals need from the real estate?

What’s the risk of overconcentration in a local economy?

Could too much borrowing and use of leverage lead to financial stress or failure?

How Real Estate Holdings Affect the Owner

Is the home right for the family?

Does the owner want to be a landlord, and will the property be managed personally or by a property manager?

What additional liability or risks could a rental property introduce?

Is your city and state landlord or tenant friendly?

Timing

When will home prices resume their upward climb in the area?

Have mortgage rates peaked or might they move higher?

If they have peaked, when will they move lower?

Finances and Taxes

What’s the time frame for excluding gain on the sale of the current home?

What are the rules for deducting interest on a loan to purchase the new home?

Is it better to take out a traditional mortgage or use other lending methods to finance the purchase?

What are the tax rules for renting out the old home?

Next Steps

Evaluate real estate assets and whether the current home is a good long-term fit

Work with a local real estate agent to determine if there are desirable upgrade opportunities

Decide whether to sell or convert the current home to a rental or stay the course

Determine if the new property purchase will be cash or financed

If the purchase is financed, determine the option with favorable tax and cash flow implications

Analyze the proposed strategy for its impact on the long-term financial plan

Millan + Co. is Here to Help

To learn more about considerations around making a move in this high interest mortgage environment and how to weigh the benefits and costs to your financial plan, contact us.