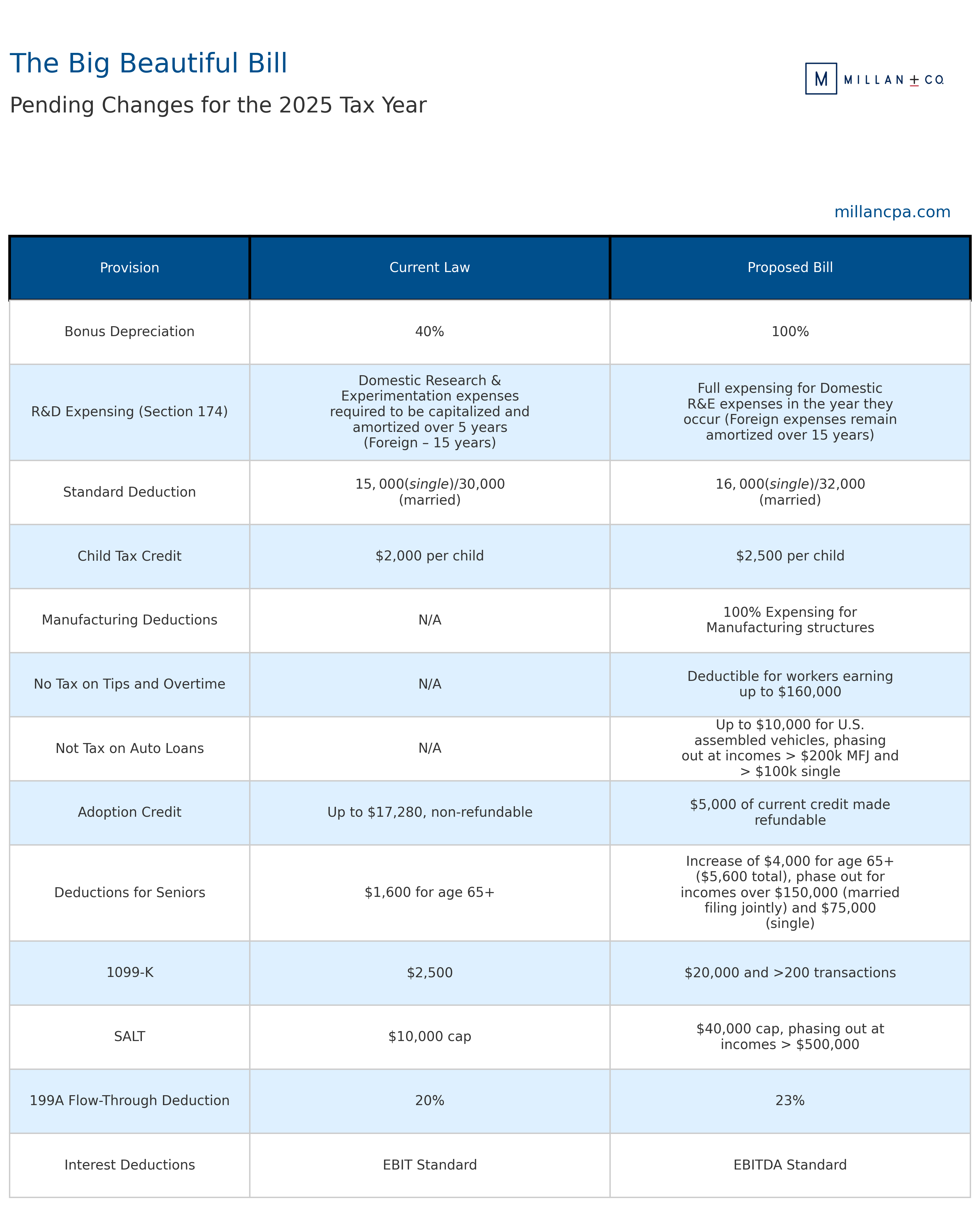

The Big Beautiful Bill - Expected Changes for the 2025 Tax Year

Ryan Millan, CPA

A high-level glance at the House-passed “One, Big, Beautiful Reconciliation Bill" on May 22, 2025.

Overall, the bill would prevent tax increases on 62 percent of taxpayers that would occur if the Tax Cuts and Jobs Act expired as scheduled. However, by introducing narrowly targeted new provisions and sunsetting the most pro-growth provisions, like bonus depreciation and research and development (R&D) expensing, it leaves economic growth on the table and complicates the structure of the tax code.

Several provisions are temporary, sunsetting in tax year 2028 and beyond.

Individual Provisions

- Make the expiring rate and bracket changes of the TCJA permanent and increase the inflation adjustment for all brackets excluding the 37 percent threshold

- Make the expiring standard deduction levels permanent and temporarily boost the standard deduction by $2,000 for joint filers, $1,500 for head of household filers, and $1,000 for all other filers from 2025 through the end of 2028

- Make the personal exemption elimination permanent

- Make the $750,000 limitation and the exclusion of interest on home equity loans for the home mortgage interest deduction permanent.

- Make the state and local tax (SALT) deduction cap permanent at a higher threshold of $40,000, phasing down to $10,000 at a rate of 30 percent beginning at modified adjusted gross income of $250,000 for single filers and $500,000 for joint filers. The cap and income thresholds increase by 1 percent per year over the next 10 years.

- Make other changes and limitations to itemized deductions permanent, including: the limitation on personal casualty losses and wagering losses and termination of miscellaneous itemized deductions, Pease limitation on itemized deductions, and certain moving expenses

- Limit the value of itemized deductions to 32 or 35 cents on the dollar for those in the top tax bracket

- Make the expiring child tax credit permanent; temporarily increase the maximum credit to $2,500 from 2025 through the end of 2028; inflation adjust the $2,000 max in years thereafter

- Make the increase in the alternative minimum tax exemption and phaseout thresholds permanent and adjust related inflation indexing calculations

- Repeal several Inflation Reduction Act (IRA) green tax subsidies primarily aimed at individuals, such as electric vehicle and residential energy efficiency credits, after 2025

- Temporarily make tip income deductible for tax years 2025 through 2028 for individuals in traditionally and customarily tipped industries, excluding highly compensated employees

- Temporarily make auto loan interest deductible for itemizers and non-itemizers for autos with final assembly in the United States for tax years 2025 through 2028; deduction limited to $10,000 and phases out by $200 for every $1,000 of income above $100,000 for single filers and $200,000 for joint filers

- Temporarily increase the additional standard deduction for seniors by $4,000 for tax years 2025 through 2028 and extend the increase to itemizers; larger deduction phases out at a 4 percent rate when modified adjusted gross income exceeds $75,000 for single filers and $150,000 for joint filers

- Temporarily make overtime compensation deductible for the premium portion of overtime for itemizers and non-itemizers for tax years 2025 through 2028, excluding highly compensated employees and qualified tips

- Tighten rules on claims for premium tax credits (PTCs) and repeal limitations on PTC clawbacks for credits advanced to taxpayers

Business and International Provisions

- Permanently reduce the post-2025 global intangible low taxed income (GILTI) inclusion rate from 62.5 percent to 50.8 percent, increase the foreign-derived intangible income (FDII) deduction from 21.875 percent to 36.5 percent, and reduce the base erosion and anti-abuse tax (BEAT) rate from 12.5 percent to 10.1 percent.

- Make the Section 199A pass-through deduction permanent; increase the deduction percentage from 20 percent to 23 percent; modify the limitations based on W-2 wages and capital investment and for specified services and trade businesses (SSTBs)

- Close SALT cap workarounds for pass-through businesses that are considered SSTBs under Section 199A

- Make the noncorporate loss limitation permanent and tighten related rules

- Sunset major IRA clean electricity tax credits: clean electricity production tax credit (45Y) and clean electricity investment tax credit (48E) eliminated for projects for which construction begins more than 60 days after enactment or property placed in service after 2028, except for advanced nuclear projects under construction before 2029; nuclear electricity production tax credit (45U) eliminated after 2031; repeal hydrogen production credit (45V) for facilities beginning construction after 2025

- Phase out advanced manufacturing production credit (45x) for wind energy components after 2027, for all other eligible components after 2031

- Across several IRA green energy credits, further restrict credits based on involvement of foreign entities of concern (FEOC)

- Expand clean fuel production credit (45K)

- Tighten rules on the 162(m) limitation for executive compensation

- Limit deductibility of C corporation charitable contributions by implementing a 1 percent floor on the deduction

- Temporarily restore 100 percent bonus depreciation for short-lived investment from 2025 through 2029

- Temporarily restore immediate expensing for domestic research and development (R&D) expenses from 2025 through 2029

- Temporarily reinstate the EBITDA-based limitation on business net interest deductions from 2025 through 2029

- Temporarily provide 100 percent expensing of qualifying structures in manufacturing, extraction, and agriculture sectors for which construction begins before the end of 2028 and placed in service date occurs before the end of 2032.