The SALT Deduction + SALT Deduction Fairness Act / H.R. 2555

Millan + Co. | Certified Public Accountants & Consultants

SALT Deduction Article Summary

History and purpose of the U.S. “State and Local Taxes Deduction” (SALT)

Which Americans are affected by the SALT Deduction?

The newly proposed “Salt Deduction Fairness Act” for married filers

The alternatively proposed “SALT Deductibility Act” / (H.R. 2555)

Optimizing itemized deductions beyond SALT (rental taxes, self employment)

History and Purpose of the SALT Deduction

The U.S. state and local tax (SALT) deduction provides taxpayers of high-tax states with relief to deduct state and local tax payments on their annual federal taxes with the IRS. This deduction has been around since 1913, with the beginning of federal income taxes in the United States. Eliminating the deduction would create double taxation on mandatory state and local income, property and sales taxes.

The SALT deduction and other tax expenditures, like the mortgage interest deduction and capital gains tax breaks, costs the federal government trillions in lost revenue, over 8% of GDP in 2017 according to the Congressional Budget Office. SALT caps were implemented to recoup some of this lost revenue in 2018. Prior to this change, no SALT deduction limit was imposed.

Under the Tax Cuts and Jobs Act enacted by President Trump in 2017, a cap was instituted on the SALT deduction. Beginning in the 2018 tax period, the deduction was capped at $10,000 for both single and married filers, effectively penalizing married people who file separately to a combined deduction of $10,000 per household. Pending U.S. legislation, under two separate bills, aims to remedy these issues with some fine tuning.

Which Americans are affected by the SALT Deduction?

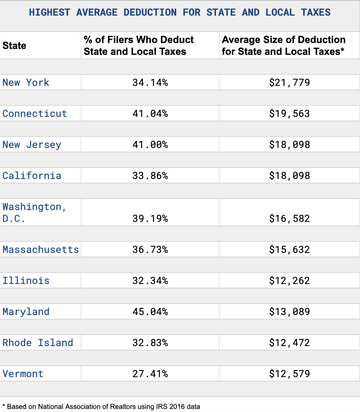

High-income taxpayers over $100,000 have the largest tax increases both as a percentage of income and dollars. The top 10 states with the highest average deduction for state and local taxes are currently most impacted with the recent SALT cap. Residents of high-tax New York, Connecticut, New Jersey, California, Washington D.C., Massachusetts, Illinois, Maryland, Rhode Island are hit hardest.

Highest Average Deduction For State & Local Taxes

Do you have to be wealthy to feel the shock? Is the deduction reduction just a problem for high net-worth individuals and households? No. Middle class filers who itemize, notably with significant property taxes, already feel the pinch. Is there any recourse? Yes, in some specific circumstances. Currently, there are a few accounting methods available that can help reduce the total tax liability by optimizing your itemizations and we will cover those practices later in this article.

Low-income taxpayers, despite a less direct blow, will likely be indirectly affected by the change as state and local governments could opt to decrease localized tax rates, leading to a decrease in spending on state and local sponsored services and programs.

The recently proposed changes by Congress have the potential to help all income classes by increasing the deduction amount for married tax filers and another bill aims to entirely eliminate the cap once again. Both bills have some form of bipartisan support, but which is more likely to pass? Let’s take a look into each of these two bills below.

The Salt Deduction Fairness Act

The SALT Deduction Fairness Act aims to ensure that limits on state and local tax deductions do not penalize married filers. Currently SALT deductions create a situation “where married couples would have been better off financially were they not married,” says Senator Susan Collins (R-ME) who introduced the SALT Deduction Fairness Act. The bill focuses on eliminating the marriage penalty associated with the SALT deduction, allowing married taxpayers to claim higher deductions and receive equitable treatment compared to single filers.

At present, the maximum amount of state and local taxes that both single and married taxpayers can deduct from their annual income taxes is limited to $10,000, where single filers and married filers are treated unequally. Married people who file separately are limited to $5,000 each, less per person than a single filer who is allowed $10,000. The SALT Deduction Fairness Act would eliminate this penalty by doubling the deduction to $20,000 for married filers.

H.R. 2555: The SALT Deductibility Act

The “Securing Access to Lower Taxes by Ensuring (SALT) Deductibility Act” / (H.R. 2555) is another bipartisan bill, introduced by Rep. Andrew Garbarino (R-NY-02), that addresses concerns related to the SALT deduction. This proposal would entirely eliminate the existing cap which was introduced under the 2018 Tax Cuts and Jobs Act (TCJA) using a phased-in approach.

Bipartisan support of this legislation includes Representatives Josh Gottheimer (D-NJ-05), Young Kim (R-CA-40), Anna Eshoo (D-CA-16), Chris Smith (R-NJ-04), Brad Schneider (D-IL-10), Mike Lawler (R-NY-17), and Rob Menendez (D-NJ-08).

Key provisions of H.R. 2555

1. Increase in SALT Deduction Cap: The SALT Deductibility Act seeks to raise the current $10,000 cap on the SALT deduction, allowing taxpayers to deduct a higher amount of state and local taxes paid from their federal tax liability. This provision aims to alleviate the burden on taxpayers in high-tax states.

2. Phased-In Deduction Cap: H.R. 2555 proposes a phased-in approach to the deduction cap, gradually increasing the limit over time. This gradual increase aims to provide immediate relief to taxpayers while allowing for a smoother transition in tax planning and budgeting.

3. Extension of Deduction to All Taxpayers: Unlike the Salt Deduction Fairness Act, which specifically addresses the marriage penalty, H.R. 2555 extends the increased SALT deduction cap to all taxpayers, regardless of marital status. This provision aims to ensure that all individuals facing high state and local taxes can benefit from the proposed changes.

In the press release of this bill, Garbarino said, "The SALT deduction cap has devastated my community by placing an unfair financial burden on Long Islanders and on taxpayers across the country."

Adding, "Long Islanders pay some of the highest property taxes in the country and, for the hardworking middle-class families in my district, the $10,000 cap means they are only able to deduct a fraction of what they pay from their federal income taxes. I am talking about police officers, firefighters, nurses, teachers, and small business owners who are being double taxed on money that was never available to them."

"The cap on SALT deductions has hurt Illinois families and local communities. Forcing Americans to pay federal tax on taxes they already paid to state and local governments is double taxation and it's wrong. In my Illinois district, approximately 42 percent of filers use the SALT deduction, and the average deduction is significantly higher – nearly double - the new cap. The SALT cap is not fair to America's middle class, and I'm proud to be leading the way with this bipartisan legislation," Schneider added.

Whether either of these federal bills will make it to the floor of Congress remains to be seen given the recent 2023 debt ceiling negotiations.

Additional Itemized Deductions, Beyond the SALT Deduction

Rental Property Taxes- Using Schedule E

IRS Schedule E is used by real estate investors of all levels to report “supplemental income and loss” (not earned income with Schedule C). Supplemental income is generally termed passive income. Because rental real estate generates passive income, the income and loss is reported separately on Schedule E.

Rental property owners may be eligible to take not only their general property associated expenses, but also their property taxes, school district taxes, special easements and land taxes as a business income expense on Schedule E instead of limiting them to personal deductions on Schedule A.

Oftentimes, the deduction of property tax, mortgage interest, and depreciation will result in a rental real estate loss. This can be advantageous to your yearly tax bill, however there are some limitations for how much of these losses you may apply to your other income.

If adjusted gross income (AGI) is < $100k, max deduction is $25,000;

If AGI is $100-150k, the max $25k deduction is phased out slowly;

If AGI is > $150k the passive loss can only be claimed by a “real estate professional”

If AGI is over 150k then IRS Form 8582 should be used to document “unallowed losses”, which can be carried forward until they can offset rental income or property sale gains from a rental property. High-income earners can only avoid tax on rental income, not earned income from their jobs.

In the case where a principal and their spouse jointly own an entity that owns a rental property, tax reporting can become quite complicated and you will need to consult with a qualified CPA.

Schedule C Self Employment Income and Expense

Filers can apply a portion of their yearly property tax to indirect costs of their home office. The remaining tax can be deducted on schedule A as an itemized deduction, limited to the $10,000 SALT limitation.

Millan + Co. is here to help guide you with the complexities of the SALT Deduction

Have questions on how best to maximize your SALT deduction? Contact us to ensure you're optimizing your finances. We track pending legislation and changes to the tax code for our clients so they don't have to. Reach- out to us today to schedule a consultation.