Bonus Depreciation Rules for 2025 and Beyond

Ryan Millan, CPA

Executive Summary

Bonus depreciation is back in a big way. Under the One Big Beautiful Bill Act of 2025 (“OBBBA”), 100% bonus depreciation is permanently restored for qualified property acquired on or after January 20, 2025. Property acquired on or before January 19, 2025 generally follows the pre-existing schedule (e.g., 40% for 2025). This clarity gives business owners confidence to invest and deduct more, sooner.

Vehicles subject to the “luxury auto” rules still face specific dollar caps-even when bonus depreciation applies-while heavy SUVs/trucks (GVWR > 6,000 lbs) are treated differently (see below). The Section 179 deduction remains a powerful companion: up to $1,250,000 in 2025, with a $3,130,000 phase-out threshold, plus a specific SUV cap of $31,300. (IRS)

This guide covers:

What changed for bonus depreciation in 2025 (and the simple rule of thumb)

How Section 179 and Bonus Depreciation are similar, different, and work together

2025 vehicle limits and best practices to avoid audits

Practical examples for real estate, medical, legal, construction and tech

Texas-specific franchise/margin tax nuances

FAQs and quick-reference aids

Sizeable Bonus Depreciation Changes in 2025

100% bonus depreciation is permanently available for qualified property acquired on/after Jan 20, 2025; otherwise, property acquired earlier and placed in service in 2025 generally gets 40%.

Practical takeaway: If you’re planning a major purchase, confirm the acquisition date and in-service date with your CPA to determine whether you qualify for 100% or 40% in 2025.

Bonus Depreciation- Simplified

What it is: An “extra-first-year” deduction for qualified property (generally recovery period ≤ 20 years)- equipment, machinery, computers, furniture, and certain building improvements. It can apply to new or used property (if new to you).

Why it matters: Big upfront deductions reduce taxable income more than longer depreciation methods.

What’s “permanent” now: OBBBA restores 100% bonus for qualifying acquisitions on/after Jan 20, 2025-going forward.

Vehicle Write-Offs (2025+)

A) Passenger “Autos” (including trucks/vans under IRS §280F)

These are subject to annual dollar caps. For vehicles placed in service in 2025, the IRS limits are:

With bonus depreciation allowed: Year 1 $20,200, Year 2 $19,600, Year 3 $11,800, Later $7,060

Without bonus depreciation: Year 1 $12,200, then the same later-year caps above.

Even where 100% bonus depreciation is available (under OBBBA), §280F still caps first-year depreciation for passenger autos.

B) Heavy SUVs/Trucks (GVWR > 6,000 lbs and < 14,000 lbs)

Not subject to the passenger “luxury auto” dollar caps under §280F.

However, Section 179 for SUVs over 6,000 lbs has a special $31,300 cap in 2025; bonus depreciation has no comparable SUV dollar cap if the vehicle otherwise qualifies (business use > 50%, etc.)

Tip: Verify the door-jamb GVWR plate and maintain mileage logs to substantiate the >50% business use requirement.

Section 179 vs. Bonus Depreciation - What’s the Difference?

Both provisions accelerate deductions; they’re just engineered differently. Here’s the owner-friendly version:

Section 179 (2025)

Deduct up to $1,250,000 of qualifying property purchases in a given year; phases out as total purchases exceed $3,130,000.

Limited to taxable income (can’t create a loss); any excess carries forward.

You choose which assets to expense first; basis of expensed assets is reduced by the 179 amount.

Bonus Depreciation (2025 and beyond)

100% for qualified property acquired on/after Jan 20, 2025; 40% for property acquired earlier and placed in service in 2025.

No dollar cap; can create a net loss (Net Operating Loss rules apply).

Applies to new or used qualifying property (new to you).

Similarities

Both cover most equipment, computers, furniture, certain property improvements, and eligible business vehicles.

Both front-load deductions into the first year.

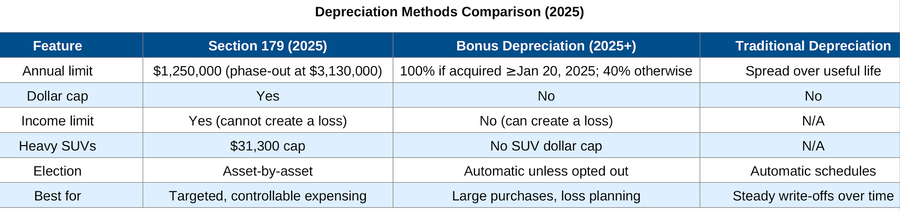

Section 179 vs. Bonus Depreciation vs. Traditional (at a glance)

Where the Two Depreciation Methods Synergize

Apply Section 179 first on targeted assets to hit income goals.

Then apply bonus depreciation to the remaining basis for a larger first-year write-off (100% or 40%, depending on acquisition date).

Example (equipment, $2.0M in 2025):

Elect Section 179 on $1.25M.

Remaining $750k: if the assets qualify for 100% bonus (acquired ≥ Jan 20, 2025), deduct the full $750k; if acquired earlier, 40% = $300k.

Upfront deduction: $2.0M (100% case) or $1.55M (40% case).

Stacking Order

Order of operations when both methods are combined: Elect Section 179 first on chosen assets → then apply bonus depreciation to the remaining basis → depreciate the rest under the IRS' Modified Accelerated Cost Recovery System (MARCS). (IRS basis rules require reducing basis for Section 179 before subsequent depreciation allowances.)

Business vs. Personal Use: Qualifying Rules

The 50% rule: To claim bonus depreciation or Section 179 on vehicles and listed property, business use must exceed 50%.

Documentation: Keep "contemporaneous "mileage logs (date, purpose, odometer), receipts, and usage policies. (Per IRS).

Recapture risk: If business use drops ≤ 50% later, expect potential recapture (give back a portion of prior deductions).

Passenger autos vs. heavy SUVs: Know which bucket you’re in; the record-keeping burden remains either way. (IRS)

Industry-Specific, Real-World Examples

Real Estate (investors, developers, property managers)

Appliances, flooring, HVAC, and built-ins often qualify; cost segregation can accelerate more.

A $600k interior refresh on a commercial building acquired in mid-2025 can unlock large year-one deductions (100% if assets qualify and were acquired ≥ Jan 20, 2025).

For long-term planning, blend Section 179 (targeted items) with bonus depreciation.

Medical & Dental Practices

Imaging systems, dental chairs, sterilization units, lab equipment, IT hardware.

Example: $500k equipment package acquired in late-2025 → Sec 179 on high-cost items + 100% bonus on the rest (if timing qualifies) = near-total first-year expensing.

Law Firms

Servers, case-management hardware, conference room build-outs, furniture.

- Use Section 179 to right-size deductions to your income in a strong year, then bonus depreciation to finish the job.

Construction & Trades

Excavators, cranes, trucks, tools, prefabrication equipment.

Example: $1.2M in gear acquired after Jan 20, 2025 → combine 179 + 100% bonus for a near-complete upfront write-off (watch §280F for light vehicles).

Tech & Startups

Servers, networking, off-the-shelf software, lab/testing gear.

Example: $300k servers acquired Q3 2025 → 100% bonus if qualified (acquired ≥ Jan 20) or 40% otherwise; layer 179 if needed for income smoothing.

Texas-Specific Considerations

Texas has no personal income tax, and the state’s franchise (margin) tax is a separate calculation based on margin methods (COGS, compensation, 30% of revenue, or EZ method). Bonus depreciation can influence federal/taxable income planning, but the Texas COGS rules differ:

Texas COGS does allow depreciation and Section 179 expense directly related to production-but does not allow federal bonus depreciation as part of COGS.

If you use the COGS method for franchise tax, your depreciation included in COGS is generally limited to regular depreciation/179, not bonus.

Manufacturing exemptions and sales/use tax rules are separate from depreciation; plan purchases with both sets of rules in mind. (Texas Comptroller, STAR)

Quick reminder: Texas franchise tax is administered by the Texas Comptroller; method elections and thresholds change-verify your facts each year. (Texas Comptroller)

Best Practices to Avoid IRS Trouble

Prove business use (> 50%) for vehicles and listed property-keep mileage logs and purpose notes.

Document acquisition dates: 2025 eligibility hinges on whether property was acquired before or after Jan 20, 2025.

Policy & substantiation: Have written policies on vehicle use; require contemporaneous logs from employees.

Coordinate with financing: Sign dates, in-service dates, and vendor delivery matter for timing.

Model the TX angle if applicable: Franchise tax method selection (COGS vs compensation vs 30% vs EZ) can change your optimal depreciation approach.

FAQs

Is 100% bonus depreciation available in 2025?

Yes- if the property is acquired on/after Jan 20, 2025. Property acquired earlier and placed in service in 2025 generally gets 40%.

Can I still expense up to 100% without bonus?

Yes-Section 179 allows up to $1,250,000 (subject to the $3,130,000 phase-out and income limits). It’s elective and can be layered with bonus depreciation.

What are the 2025 “luxury auto” limits?

If bonus applies, Year 1 $20,200 (then $19,600 / $11,800 / $7,060). Without bonus, Year 1 $12,200.

How do heavy SUVs work?

Vehicles with GVWR > 6,000 lbs aren’t subject to the passenger-auto caps; Section 179 has a $31,300 SUV cap in 2025; bonus depreciation can apply (no SUV dollar cap) if business use > 50% and other rules are met. (IRS)

What about Texas?

Texas has no personal income tax; the franchise (margin) tax allows depreciation and Section 179 in COGS but not bonus depreciation in COGS. Plan accordingly.

Do nonprofit organizations qualify for bonus depreciation or Section 179?

Generally no, because nonprofits are tax-exempt and these provisions reduce taxable income. However, two exceptions apply:

-

If the nonprofit has unrelated business taxable income (UBTI), bonus depreciation and Section 179 may be used to offset that income.

-

If the nonprofit operates through a for-profit subsidiary, that entity can fully use these deductions like any other business.

If a nonprofit generates taxable business income unrelated to its exempt purpose (e.g., a charity runs a coffee shop), it must file Form 990-T.

For most exempt activities, these provisions won’t apply unless taxable income is involved.

Professional Depreciation and Tax Planning

If you’re considering equipment, vehicles, or improvements in 2025, the acquisition date and in-service date can be the difference between 100% now and 40% now.

Millan & Company specializes in tax planning and we are here to help :

Plan acquisitions to qualify for 100% depreciation where advantageous;

Layer Section 179 + Bonus Depreciation for maximum first-year savings or gradual savings within an optimized, longer term, tax planning strategy;

Cost segregation studies for both accelerated and balanced depreciation;

Navigate Texas franchise tax choices and documentation.

Contact us to discover what's possible. We focus on client satisfaction at the highest level of quality.