CTA | FinCEN - Beneficial Ownership Information Reporting Begins 1/24 for Most LLCs, LLPs, LLLPs and Trusts

Ryan Millan, CPA

Update:3/24/25 - FinCEN Removes Beneficial Ownership Reporting Requirements for U.S. Companies and U.S. Persons, Sets New Deadlines for Foreign Companies

WASHINGTON––Consistent with the U.S. Department of the Treasury’s March 2, 2025 announcement, the Financial Crimes Enforcement Network (FinCEN) is issuing an interim final rule that removes the requirement for U.S. companies and U.S. persons to report beneficial ownership information (BOI) to FinCEN under the Corporate Transparency Act.

In that interim final rule, FinCEN revises the definition of “reporting company” in its implementing regulations to mean only those entities that are formed under the law of a foreign country and that have registered to do business in any U.S. State or Tribal jurisdiction by the filing of a document with a secretary of state or similar office (formerly known as “foreign reporting companies”). FinCEN also exempts entities previously known as “domestic reporting companies” from BOI reporting requirements.

Thus, through this interim final rule, all entities created in the United States — including those previously known as “domestic reporting companies” — and their beneficial owners will be exempt from the requirement to report BOI to FinCEN. Foreign entities that meet the new definition of a “reporting company” and do not qualify for an exemption from the reporting requirements must report their BOI to FinCEN under new deadlines, detailed below. These foreign entities, however, will not be required to report any U.S. persons as beneficial owners, and U.S. persons will not be required to report BOI with respect to any such entity for which they are a beneficial owner. For more information, see https://fincen.gov/news/news-releases/fincen-removes-beneficial-ownership-reporting-requirements-us-companies-and-us.

Update 3/4/25: The U.S. Treasury announces it won't require BOI reporting or penalties against U.S. citizens, businesses.

U.S. citizens and businesses will not be subject to fines or penalties for failing to file beneficial ownership information (BOI) reports after new reporting deadlines are set, Treasury said Sunday in a news release.

Additionally, the Treasury said "it will further not enforce any penalties or fines against U.S. citizens or domestic reporting companies or their beneficial owners after the forthcoming rule changes take effect."

Treasury will issue proposed rulemaking that will "narrow the scope of the rule to foreign reporting companies only," the news release said.

BOI requirements were established as part of the Corporate Transparency Act (CTA), P.L. 116-283, passed by Congress in 2021.

"This is a victory for common sense," Treasury Secretary Scott Bessent said in Sunday's release. "Today's action is part of President Trump's bold agenda to unleash American prosperity by reining in burdensome regulations, in particular for small businesses that are the backbone of the American economy."

FinCEN had estimated that 32 million small businesses would have to report BOI, which provided details on who owned or controlled them.

Update 2/28/25: BOI Reporting Deadline Extended Past 3/21/25. Enforcement Suspended.

The Financial Crimes Enforcement Network (FinCEN) will extend the current March 21 beneficial ownership information (BOI) reporting deadline, has suspended BOI enforcement, and will develop new regulations it says will reduce "regulatory burden," the agency said Thursday.

FinCEN didn't announce a new reporting deadline but said it would do so by March 21. See FinCEN's release statement.

FinCEN said it will not take any enforcement actions, including not issuing fines or penalties, based on a failure to file or update BOI reports by the current deadlines until an interim final rule becomes effective and the new relevant due dates in the interim final rule have passed.

The FinCEN release said the agency recognizes "the need to provide new guidance and clarity as quickly as possible, while ensuring that BOI that is highly useful to important national security, intelligence, and law enforcement activities is reported."

Update Alert

Update Alert: 2/18/25 -

A federal court order late Monday (2/16/25) lifted the last remaining nationwide injunction stopping beneficial ownership information (BOI) filing requirements. FinCEN has promised at least a 30-day delay before new filings will be required.

The Financial Crimes Enforcement Network (FinCEN), which enforces BOI requirements under the Corporate Transparency Act (CTA), P.L. 116-283, said earlier in an alert on its site: "FinCEN intends to extend the reporting deadline for all reporting companies 30 days from the date the stay is granted. Further, in keeping with Treasury's commitment to reducing regulatory burden on businesses, FinCEN, during that 30-day period, will assess its options to modify further deadlines or reporting requirements for lower-risk entities, including many U.S. small businesses, while prioritizing reporting for those entities that pose the most significant national security risks."

At the time of publication, FinCEN had not updated its site with specific dates but it is estimated to be March, 21st.

Also, fines were increased to $606 from $591, effective Jan. 17th. The original fine was $500. This is a developing story. Check journalofaccountancy.com for any future changes.

This latest finding is expected to be the final ruling from the courts.

For requirements on who must file, see the article below.

Update Alert: 2/7/25- BOI Filing is Currently Postponed But Fines Are Being Assessed

Most recently FinCEN has confirmed reporting companies are not required to currently file BOI reports as the DOJ and the courts settle appeals. Note: daily fines are being calculated should the rule be implemented.

In its motion to lift the injunction, the government notes that the details of the reporting requirements were set administratively by FinCEN in a final rule, rather than being specified by Congress in the CTA.

"As a matter of policy, Treasury continues to assess the potential burden of the Final Rule. If this Court grants the stay, ... FinCEN intends to assess its potential options to prioritize reporting for those entities that pose the most significant national security risks while providing relief to lower-risk entities and, if warranted, amending the Final Rule," the motion states.

On its website, FinCEN confirmed DOJ's statement about a 30-day extension if the court stays the nationwide injunction and its plan to reassess reporting companies required to file BOI reports.

Although reporting companies are not required to file BOI reports, FinCEN is tracking daily fines should the rule be imposed.

For additional details on this topic, please reference this article by the Journal of Accountancy.

Update Alert: 1/23/25 - BOI is Currently Required as Ruled by Today's U.S. Supreme Court Ruling.

The Supreme Court action allows enforcement of the BOI registration requirement while the Texas case winds through the courts. BOI filings are now required as of 1/23/25.

The National Small Business Association is calling on Congress to delay and repeal the CTA while the Small Business & Entrepreneurship Council and other groups are calling for the Trump administration to step in and provide immediate penalty relief for late filers.

The BOI E-filing website is available at https://boiefiling.fincen.gov

We’ll continue to provide updates on this evolving issue.

Update Alert: 12/24/24: Appeals Court Reinstates BOI Filing Requirement

The original deadline of Jan. 1, 2025 remains in place.

The 5th Circuit Court of Appeals has granted the government's emergency motion to stay a Texas district court's nationwide injunction against the Corporate Transparency Act (CTA). CTA requires nonexempt companies to report their beneficial owners. Before the Texas court’s injunction, specified businesses formed prior to 2024 were required to file their initial beneficial ownership information (BOI) report with the Financial Crimes Enforcement Network (FinCEN) by Jan. 1, 2025, and new businesses were required to file within 30 days.

The stay means the CTA is now in effect. The court found that the government is likely to succeed on appeal, that leaving the injunction in place could cause significant harm, and that the public interest in preventing financial crimes outweighs any harm to the plaintiffs. The case will proceed quickly to the next available oral argument panel.

It is best to file these reports as soon as possible given the few remaining days left before the Jan. 1, 2025, due date.

BOI reporting is not required annually, and reports are only needed to be submitted once unless the filer needs to update or correct information. The BOI E-Filing website is available at https://boiefiling.fincen.gov

Article Summary and Federal Legal Update as of 12/3/24

UPDATE. Federal Legal Injunction on BOI Rule as of 12/3/24:

For now, the January 1, 2025, reporting deadline is delayed until a higher court holds otherwise. Details:

On December 3, 2024, a Texas-based federal court issued a sweeping order prohibiting the federal government from enforcing the Corporate Transparency Act (CTA) anywhere in the country. Texas Top Cop Shop, Inc., et al. v. Garland, et al., Case No. 4:24-cv-478 (E.D. Tex.). The Court held that the CTA—which would have required an estimated 32.5 million companies in the United States as of January 1, 2024, to submit sensitive information regarding their “beneficial owners” (BOI) to the United States Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) by January 1, 2025—was likely unconstitutional and that its implementation would irreparably harm reporting companies if they were forced to comply.

This means that “[existing] reporting companies need not comply with the CTA’s January 1, 2025, BOI reporting deadline,” and that FinCEN cannot enforce any of the CTA’s penalties for willful noncompliance against entities or individuals.

In addition to existing companies whose reporting deadline was just weeks away, the CTA requires companies created or registered in the United States during 2024 to submit a BOI report to FinCEN within 90 days of creation or registration, which timeframe shortens to 30 days as of January 1, 2025. According to FinCEN’s estimates, 5 million companies are created or registered in the United States each year and would be captured. As of last month, reportedly more than 8 million BOI reports had been submitted to FinCEN, most of which were presumed filed by newly formed reporting companies. The Court’s order enjoins enforcement of the entirety of the CTA.

The Court’s decision will likely not be the final word on the CTA’s enforceability. To begin, the Court entered only a preliminary injunction, which it could theoretically reconsider at some point in the future. The more likely next step, however, is that the government will immediately appeal this decision to the United States Court of Appeals for the Fifth Circuit. A further appeal could be taken to the United States Supreme Court. But unless a court specifically dissolves the Texas Top Cop Shop injunction, companies will not be required to comply with the CTA’s reporting requirements.

---------------------

Beginning on January 1, 2024 the U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN), under the 2021 Corporate Transparency Act, will require millions of small businesses and some corporation types (LLCs and more) to file a Beneficial Ownership Information (BOI) report.

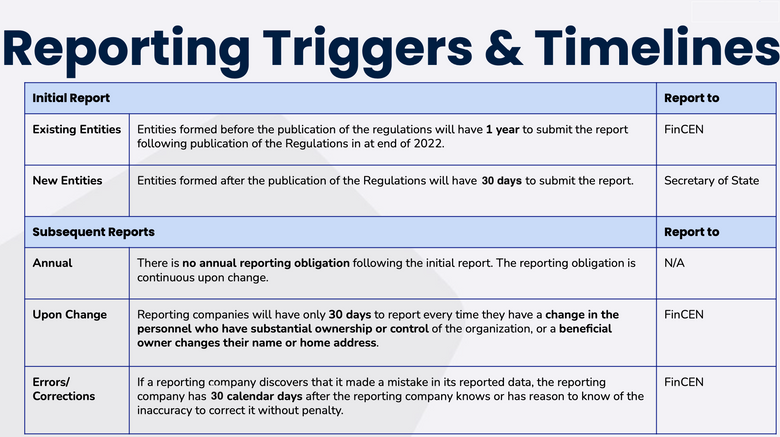

The deadline for beneficial ownership information (BOI) reporting depends on when the company was created or registered:

- Before January 1, 2024: The initial BOI report is due by January 1, 2025

- In 2024: The BOI report is due within 90 days of receiving notice that the company's creation or registration is effective

- On or after January 1, 2025: The BOI report is due within 30 days of receiving notice that the company's creation or registration is effective

BOI reporting is not required annually, and reports are only needed to be submitted once unless the filer needs to update or correct information. The BOI E-Filing website is available at https://boiefiling.fincen.gov

Defining types of “Beneficial Owners”

Using a FinCEN Identifier in lieu of BOI reporting

Reporting Triggers & Timelines

Non-compliance: Civil and Criminal Violations and Penalties

Purpose of the CTA’s FinCEN BOI Reporting Rule

The Corporate Transparency Act (CTA), was enacted via bipartisan congressional legislation in 2021. The act was created to help protect the U.S. financial system and national security interests against criminal use and provide critical information to intelligence and law enforcement agencies, Tribal officials and financial institutions to uncover cartels, drug and human traffickers, corrupt officials, some oligarchs and fraudsters from using shell companies to hide and launder assets in the United States.

The CTA is the United State’s implementation of “Ultimate Benefit Ownership” (UBO) - which is a global regulatory movement in disclosure legislation aimed at tackling financial crimes. The U.S. is lagging behind other G20 countries in this area as the rest of the G20 already has UBO in place.

The Financial Crimes Enforcement Network (FinCEN), the strategic enforcement department of the U.S. Treasury, is responsible for implementing and managing the Corporate Transparency Act’s (CTA) beneficial ownership information reporting provisions.

Beginning January 1, 2024 the new U.S. Federal regulations will go into effect, requiring many corporations, limited liability companies (LLCs) and other “entities”- which are either created in or are registered to do business in the U.S.- to report information regarding their “beneficial owners” (the persons who actually own or control a company) to FinCEN.

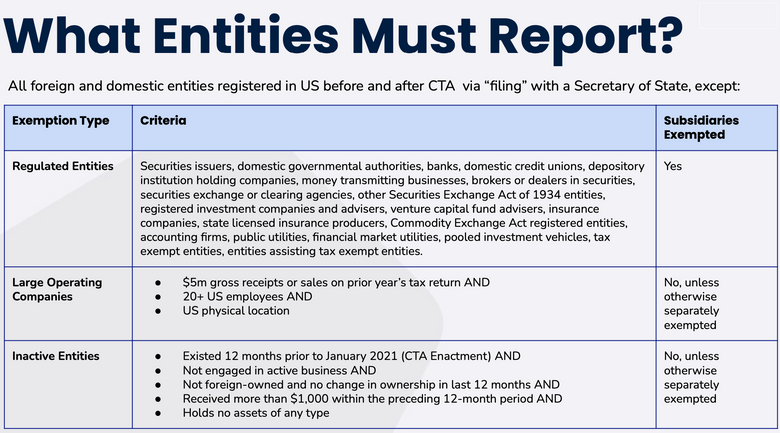

What Entities (or “Reporting Companies”) Must Report?

The BOI rule identifies two main types of “Reporting Companies” that must comply: domestic and foreign.

A domestic Reporting Company is defined as “a corporation, limited liability company (LLC), or any entity created by the filing of a document with a secretary of state or any similar office under the law of a state or Indian tribe.”

A foreign Reporting Company is defined as “a corporation, LLC or other entity formed under the law of a foreign country that is registered to do business in any state or tribal jurisdiction by the filing of a document with a secretary of state or any similar office.”

The language of “any entity” (outside a corporation or LLC) has been criticized as too broad and further clarification is expected to help set expectations for small business owners. Generally, FinCEN expects that these definitions mean (aside from specified exemptions listed further below) limited liability partnerships (LLPs), limited liability limited partnerships (LLLPs), business trusts, and most limited partnerships -in addition to corporations and LLCs, because entities like these are generally created with a filing through a secretary of state or similar office.

Who Is Obligated To Report?

Both “Beneficial Owners” and “Company Applicants” are required to report under the new BOI rule. Let’s take a look at the specifics within each category.

Beneficial Owners

Within the BOI rule, a Beneficial Owner is defined as “any individual who, directly or indirectly, either (1) exercises substantial control over a Reporting Company, or (2) owns or controls at least 25 percent of the ownership interests of a Reporting Company.

The “substantial control” element of the rule is designed to close loopholes that allow corporate structuring which veils owners and decision makers. The spirit of the broad term is aimed specifically at unmasking anonymous shell companies. To help clarify, the BOI rule specifies a range of activities that could constitute “substantial control”. Standards are defined to specify how a Reporting Company should handle situations where ownership interests are held in a trust. The majority of reporting companies are expected to have simple ownership structures and reporting should be a straightforward process.

Five types of individuals are exempted from the definition of “Beneficial Owner.” The five exemptions include:

A minor child if the report provides information about a parent or legal guardian;

An individual acting as a nominee, intermediary, custodian, or agent on behalf of another individual;

An employee, acting solely as an employee, whose substantial control over economic benefits from such entity are derived solely from the employment status of the employee and who is not a senior officer;

An individual whose only interest is a future interest through a right of inheritance;

A creditor.

Company Applicants

The BOI rule defines a company applicant to be one of two persons:

The individual who directly files the document that creates the entity or registers the company to do business in the U.S.

The individual who is primarily responsible for directing or controlling the filing of the relevant document by another.

“FinCEN Identifier” - An Alternate Compliance Method

Individuals will be permitted to obtain a “FinCEN Identifier'', a unique number issued by FinCEN to an individual or entity upon request, which can then be provided to FinCEN on a BOI report in place of the required information about the person if they provide their four pieces of report information directly (see required four pieces of information below).

Usage of a FinCEN Identifier places the burden of updating the applicable BOI on the applicable individual or Reporting Company. Any updated applications must be filed within 30 calendar days from the date on which:

- A change occurs;

- The individual or Reporting Company becomes aware or has reason to know of an inaccuracy within an application;

- A Reporting Company can only apply for a FinCEN Identifier at or after the time that an entity submits an initial report;

- An individual can submit an application for a FinCEN Identifier which contains all of the BOI that otherwise has to be provided in the initial report about the individual. See details of what must be reported directly below.

What Must Be Reported?

The Reporting Company will be required to provide identification information about itself, and report four pieces of information about each of its Beneficial Owners and Company Applicants. Information required about the Reporting Company itself includes:

The full legal name and any trade name or “doing business as” name of the Reporting Company;

A complete current address;

The State, Tribal, or foreign jurisdiction of formation or registration of the Reporting Company; and

The IRS Taxpayer Identification Number (TIN) (including an Employer Identification Number) of the Reporting Company.

Information required of the Beneficial Owners are:

Full legal name;

Birthdate;

Address;

A unique identifying number and issuing jurisdiction from an acceptable identification document (and the image of such document).

Reporting Triggers + Timelines

Non-compliance: Civil and Criminal Violations and Penalties

Updated on 2/16/25: fines were increased to $606 from $591, effective Jan. 17th, 2025. The original fine was $500 as listed below.

___________

Failure to comply with the reporting requirements or unauthorized disclosure of BOI may result in civil or criminal actions.

Intentional failure to file a complete initial or updated report with FinCEN is subject to a US $500-per-day fine (up to US $10,000) and imprisonment for up to two years.

An individual who knowingly discloses BOI, without authorization, is subject to a US$500-per-day penalty (up to US$250,000) and up to five years’ imprisonment.

Privacy - A Secure Nonpublic Database (BOSS system)

Congress has directed the U.S. Treasury to maintain BOI in a secure nonpublic database to protect non-classified data at the highest security level possible. To meet this requirement, FinCEN has developed the Beneficial Ownership Secure System (BOSS) to receive, store, and maintain BOI. BOSS is expected to open on 1 January 2024, and Reporting Companies will provide the required BOI to FinCEN through BOSS.

BOI will be provided upon request by: federal agencies engaged in national security, intelligence, or law enforcement activity and to a State, local, or Tribal law enforcement agencies when a court of competent jurisdiction has authorized the law enforcement agency to seek the information in a criminal or civil investigation.With the consent of the Reporting Company, a financial institution can obtain BOI to facilitate compliance with customer due diligence requirements of a financial institution.

Summary

The application of the CTA is still evolving in some areas. In July of 2023, the House Financial Services Committee held hearings regarding the potential unintended consequences of FinCEN’s BOI rulemaking. Also, new proposals have been introduced that would modify FinCEN’s scope to include programs and research aimed at financial technology with machine learning, data analytics, and cryptocurrency.

The CTA will have significant implications for domestic and foreign businesses as it imposes new burdens on entities formed or operating in the United States. Determining reporting obligations and exemption eligibility is a case by case analysis that will need to be assessed with each Reporting Company’s unique circumstances. In addition, the tracking of an entity’s operation and ownership will be ongoing as changes in operations, leadership, investment or ownership may change reporting status.

Millan + Co. CTA and FinCEN Related Services

Millan + Co. offers organizations and individuals with BOI and FinCEN guidance regarding compliance requirements, however, actual BOI filings, change filings and overall BOI compliance are the sole responsibility of "Beneficial Owners" and / or "Company Applicants".

The BOI E-Filing website is available at https://boiefiling.fincen.gov

Our decades of experience with international accounting regulations can significantly help mitigate some FinCEN penalty risks.

Consultation on business incorporation services are also available for LLCs, LLPs, LLLPs, S-corps and Corporation entity formations.

This is a live document which will be updated with any significant changes to BOI regulations and dates.