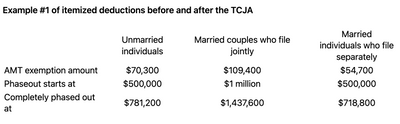

The exemption is reduced by 25% of the excess of AMT income over the applicable exemption amount. Under the TCJA, only those with really high incomes will see their exemptions phased out, while others (including middle-income taxpayers) will benefit from full exemptions.

Child tax credit

Working parents can get a credit for Child and Dependent Care Expenses “CDCEC”. This credit includes summer camp, babysitters, paid daycare or other “child care” services. This credit only applies to children under the age of 13 and/or children with a disability. This credit allows you to deduct 35% of these expenses with a cap of $3,000 for one child and $6,000 for multiple children.

According to the American Camp Association, day camps cost an average of $314 per week! Specialty camps cost even more at $750 per week. At these rates, the cost of summer camp can add up quickly.

Work-related: To qualify for the credit both parents must be working or looking for work, and neither can be fully unemployed or a “stay-at-home” parent. This is a tax break meant to compensate for the fact that in order to be able to work, you need to find someone to care for your kids. Also, if your spouse is in school full-time, you can still take the deduction, despite the fact both of you are not gainfully employed.

How much: You can claim the costs of the camp itself, but not the gear and garb your child needs for camp. You can deduct medical-related expenses (i.e., a physical) on your Schedule A, itemized deduction schedule as well.

Form 2441: To claim a credit for child care expenses, you’ll need to attach a federal Form 2441 to a full federal form 1040. You cannot file the simplified federal forms and claim the credit.

Limitations: There are a few limits. The following don’t qualify: overnight camps, summer school tutoring, spousal care, or leaving the kids with granny.

Claiming the credit: You need to claim your provider and keep receipts.

The Tax Cuts and Jobs Act “TCJA” increases the Child Tax Credit “CTC”

The TCJA provides an expanded Child Tax Credit “CTC” and increased the incomes it applies to before the phase-out begins. The CTC still applies to dependent children as defined under IRC § 152. Under 26 U.S. Code §152(d)(1)(B), a qualifying relative includes an individual “whose gross income for the calendar year in which such taxable year begins is less than the exemption amount.” The TCJA also adds a $500 nonrefundable tax credit styled as a “Credit for Other Dependents” to give small break for dependents who are not “qualifying children.”

The CTC is $2,000 per qualifying child, which is double what was available under the old law, but it is limited to children under the age of 17. Another change is that $1,400 of this amount is potentially refundable for poorer taxpayers who already have a refund before claiming the CTC. The CTC appears on Lines 52 and 67 of the Form 1040. As for the phase-out increases, for married taxpayers filing a joint return, the phase-out now begins at $400,000 and is $200,000 for all other taxpayers.

TCJA and business owners

- TCJA made significant changes in the expenses you may deduct in your business in the following areas:

- Qualified Business Income Deduction

- Depreciation

- Business related losses

- Business related exclusions and deductions

- Business credits

- S corporations

- Farm provisions

- Miscellaneous provisions

A few key provisions include:

Qualified Business Income Deduction

Many individuals, including owners of sole proprietorships, partnerships, and S corporations and beneficiaries of trusts and estates, may be entitled to a deduction of up to 20 percent of qualified business income (QBI), plus up to 20 percent of their qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income. Generally, this deduction is the lesser of the combined QBI, REIT dividend, and PTP income amounts, or 20 percent of taxable income minus the taxpayer’s net capital gain. Claimed on Form 1040, Line 9, the new deduction is generally available to eligible taxpayers whose 2018 taxable incomes fall below $315,000 for joint returns and $157,500 for other taxpayers. The deduction may also be available for those whose incomes are above these levels but additional limitations may apply.

For an in-depth discussion for this new deduction please refer to our article on “qualified business income deduction”.

Temporary 100-percent expensing (bonus depreciation)

Businesses can write off most depreciable business assets in the year they placed them in service. The 100-percent depreciation deduction (bonus depreciation) generally applies to depreciable business assets and certain other property. Machinery, equipment, computers, appliances and furniture generally qualify. The deduction is generally allowable for qualifying property acquired and placed in service after Sept. 27, 2017, and before Jan. 1, 2023. For more information, see Publication 946, How to Depreciate Property. You can look at more info for getting your computer looked at in case it needs any repairs.

Expensing depreciable business assets

A taxpayer may elect to expense the cost of any section 179 property and deduct it in the year the property is placed into service. The new law increased the maximum deduction from $500,000 to $1 million. It also increased the phase-out threshold from $2 million to $2.5 million. After 2018, the $1 million and $2.5 million thresholds will be adjusted for inflation.

Business related losses

For most taxpayers, a net operating loss (NOL) arising in tax years ending after Dec. 31, 2017 can only be carried forward. Certain NOLs of farming businesses and insurance companies (other than life insurance) can still be carried back two years. The deduction of NOLs arising in tax years beginning after Dec. 31, 2017, is limited to 80 percent of taxable income, determined without any NOL deduction. This 80-percent limitation does not apply to insurance companies (other than life insurance). Rules for existing or pre-2018 NOLs remain the same.

Please contact us to discuss how best to maximize your filing deductions. At Millan and Co. we are business consulting CPAs who can help you in your income tax preparation and overall tax compliance.