Record-high federal estate and gift exemptions in 2026 open powerful new planning opportunities - but also new risks for families who delay updates. From permanent AMT adjustments under the One Big Beautiful Bill Act to evolving rules on trusts, basis step-ups, and gifting, today’s estate strategy requires precision. Millan & Company CPAs breaks down the key thresholds, timelines, and planning moves that can preserve wealth and strengthen multigenerational legacy in the post-2025 tax era.

2026 Estate Tax Planning: Exemptions, Gifting + Strategies

Richard Millan, CPA

2026 Estate Tax Planning Overview

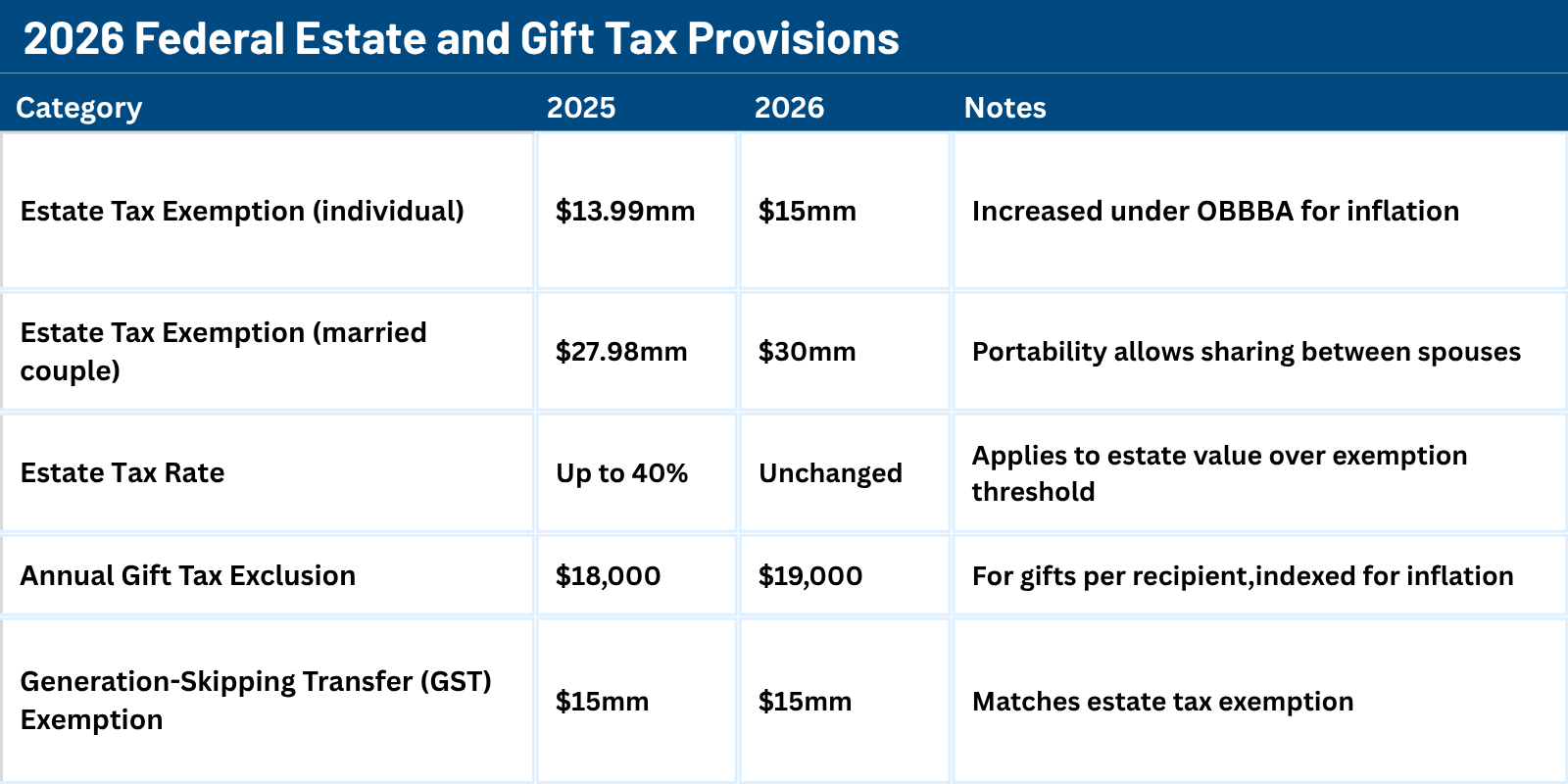

The year 2026 brings one of the most generous yet complex estate-tax landscapes in U.S. history. The federal estate and gift tax exemptions rise to record levels, while a series of quieter legislative shifts could reduce what heirs ultimately receive if plans aren’t updated.

While federal thresholds surge, it’s important to note that Texas residents do not face a state estate or inheritance tax, though they remain subject to all federal estate and gift-tax rules.

This guide outlines the new exemption limits, highlights key provisions from the Secure Act 2.0, and explains how families can optimize gifting, trusts, and charitable giving strategies under the revised framework.

The Quiet Shift Beneath the Headlines

While the $15 million estate tax exemption dominates the news, the real threat to inheritances may come from subtler tax-law changes. Adjustments to step-up-in-basis rules, trust-reporting requirements, and certain state-level inheritance taxes can quietly reduce the after-tax value of what heirs receive.

A trust drafted five years ago might now expose appreciated assets to capital-gains recognition upon liquidation. In short: even without a lower exemption, your inheritance could shrink due to technical changes. A proactive estate-plan review can prevent this.

Secure Act 2.0 Considerations

The Secure Act 2.0 continues to influence estate and retirement planning in 2026:

-

Inherited IRA Distribution Rule: Most non-spouse beneficiaries must distribute inherited IRAs within 10 years, reshaping multigenerational legacy planning.

-

Roth Conversions: Indexed income thresholds and larger catch-up contributions make Roth conversions a powerful legacy-planning tool for tax diversification and estate efficiency.

-

Liquidity Planning: Enhanced retirement-plan flexibility can help estates meet federal or state tax liabilities without forced asset sales.

Each provision interacts with estate planning differently, emphasizing the importance of a coordinated review of retirement assets, trusts, and beneficiary designations.

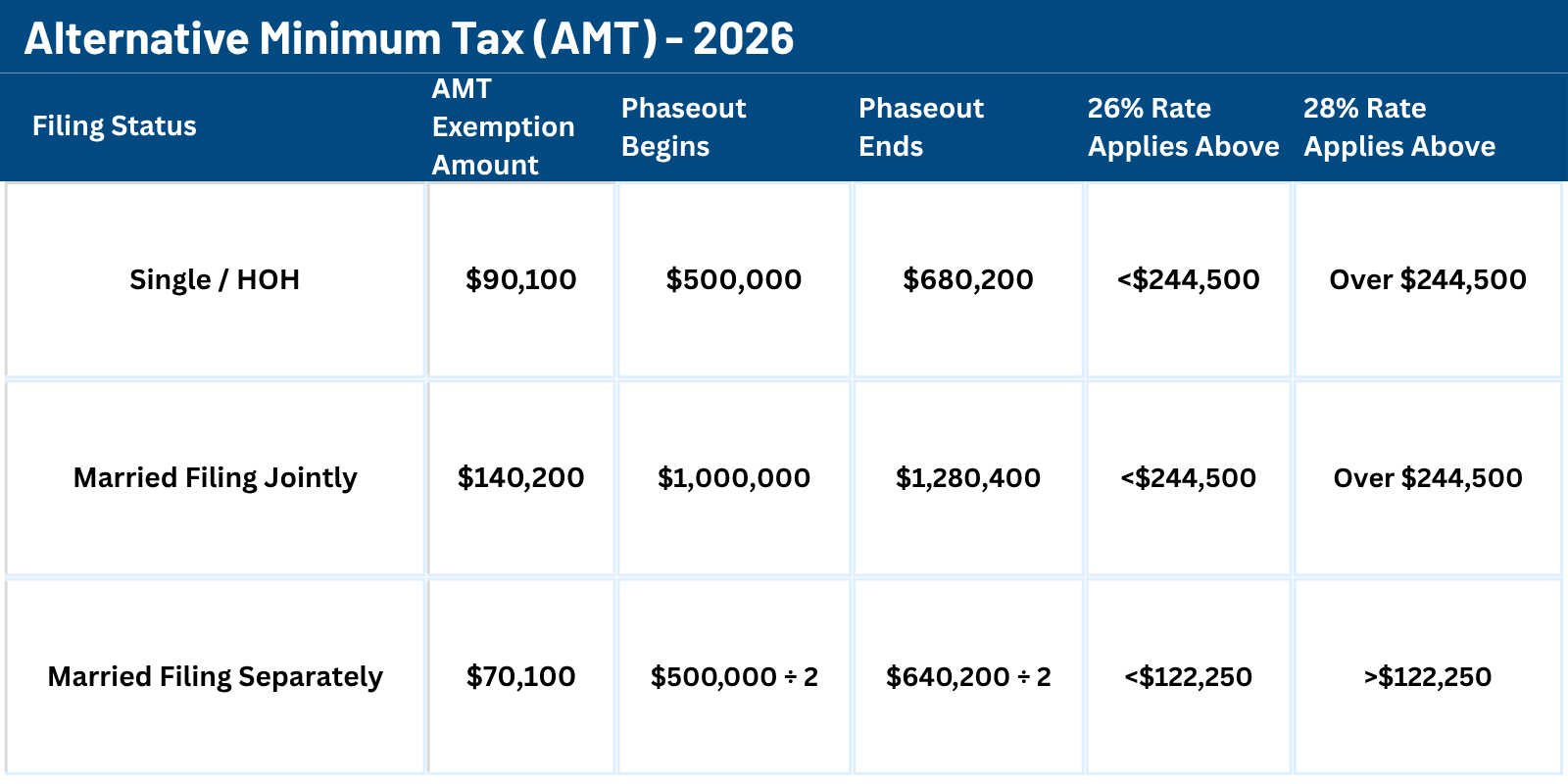

Alternative Minimum Tax (AMT) and Estate Liquidity

The Alternative Minimum Tax (AMT) ensures high-income taxpayers pay at least a minimum level of federal tax by limiting deductions and treating certain income items differently. For 2026, the AMT exemption amounts rise slightly due to inflation adjustments, but phase-out thresholds drop, meaning more upper-income filers could face AMT liability. The AMT exemptions were significantly increased under the Tax Cuts and Jobs Act (TCJA), and the One Big Beautiful Bill Act (OBBBA) makes those higher thresholds permanent, continuing to index them annually for inflation.

Related

For full capital-gains and deduction tables, see Millan & Company’s 2026 Individual Tax Brackets Guide.

For 2026 IRS Business Updates, see the 2026 IRS Tax Rules for LLCs, S Corps & Partnerships Guide

Estate Tax Planning Highlights and Implications for 2026

AMT Relief Continues

Higher exemptions of $90 000 (single) / $140 000 (MFJ) reduce AMT exposure for executives exercising incentive stock options or realizing large capital gains.

Estate Tax Exclusion Increase

The $15 million Basic Exclusion Amount (BEA) per individual expands planning room for GRATs, family-limited partnerships, and irrevocable trusts.

Annual Gift-Tax Exclusion

The $19 000 limit (or $38 000 for couples) remains a cornerstone of multi-year wealth transfer and estate-reduction strategy.

Generation-Skipping Transfer (GST) Exemption

Matching the estate threshold, the $15 million GST limit safeguards dynasty and legacy trusts from double taxation when allocations are properly structured.

Quiet Shifts You May Be Overlooking

Regulatory moves affecting basis step-ups, trust reporting, and state tax rules could quietly reduce what heirs keep - even with high federal exemptions.

Action: Audit existing trusts, confirm state residency status, and verify basis-election clauses with your estate attorney to preserve full benefits.

State Tax Impact for Texans

Residents of Texas are not subject to state estate or inheritance tax. However, they must still comply with all federal estate and gift-tax rules, including the $15 million exemption and filing Form 706 if applicable.

CPA Note: The IRS confirms that lifetime gifts made under current exemptions will not be clawed back if future legislation lowers the limit. Timely Form 706 filings remain critical for spousal portability and overall estate-tax optimization.

Frequently Asked Questions: 2026 Estate and Gift Taxes

Q: What is the federal estate tax exemption for 2026?

A: The exemption increases to $15 million per individual and $30 million for married couples, indexed annually for inflation. This threshold determines which estates owe federal estate tax.

Q: What is the top federal estate tax rate?

A: The maximum rate remains 40 percent, applied only to taxable estate value above the exemption amount.

Q: How much can I gift in 2026 without filing a return?

A: The annual gift exclusion rises to $19 000 per recipient ($38 000 for married couples). Gifts within this limit do not require filing Form 709.

Q: How does the Generation-Skipping Transfer (GST) exemption work?

A: The GST exemption matches the estate tax exemption at $15 million, protecting properly structured dynasty and legacy trusts from double taxation.

Q: Does Texas have an estate or inheritance tax?

A: No. Texas imposes no state estate or inheritance tax. Residents must still comply with federal estate and gift-tax rules, including filing Form 706 when required.

Q: Are there new deductions for seniors in 2026?

A: Yes. The temporary $6 000 Senior Bonus Deduction Program expands relief for taxpayers age 65 and older through 2026. See full details in Millan & Company’s 2026 Individual Tax Brackets and Deductions Guide.

Q: When should I update my estate plan?

A: Review your estate plan every two years or after major life, asset, or tax-law changes to ensure alignment with current rules and exemptions.

Protecting Your Legacy in 2026 and Beyond

The 2026 estate-tax landscape offers both opportunity and complexity. With the federal exemption at $15 million, annual gifting at $19 000, and no estate or inheritance tax in Texas, many families can secure multi-generational wealth with proper structure.

Yet, the quiet shifts in trust reporting, basis step-ups, and retirement-plan coordination mean even well-drafted plans need a modern review. Estate planning is no longer a one-time task — it’s an evolving discipline that integrates tax strategy, liquidity management, and family governance.

Millan & Company CPAs combines technical expertise with concierge-level service to help you:

-

Preserve wealth through proactive estate and gift planning

-

Coordinate CPA, legal, and fiduciary strategies across generations

-

Optimize liquidity and charitable giving under new 2026 thresholds

Schedule your 2026 Estate Review.

Partner with our Austin-based team to ensure your plan reflects today’s law -and tomorrow’s opportunities.