2026 IRS Tax Brackets, Standard Deductions, Capital Gains +AMT

Ryan Millan, CPA

Executive Summary

The IRS has released 2026 inflation adjustments that raise both the standard deduction and tax bracket thresholds across all filing statuses and for more than 60 tax provisions.

These updates, averaging a 2 % - 3 % increase, help offset the effects of inflation, tweak and continue the framework introduced under the One Big Beautiful Bill Act (OBBBA).

See the 2026 tables below for: Single Filers; Married FIling Jointly; Married Filing Separately; Head of Household; Standard Deductions; Capital Gains and Alternative Minimum Tax (AMT) brackets for 2026 tax year planning.

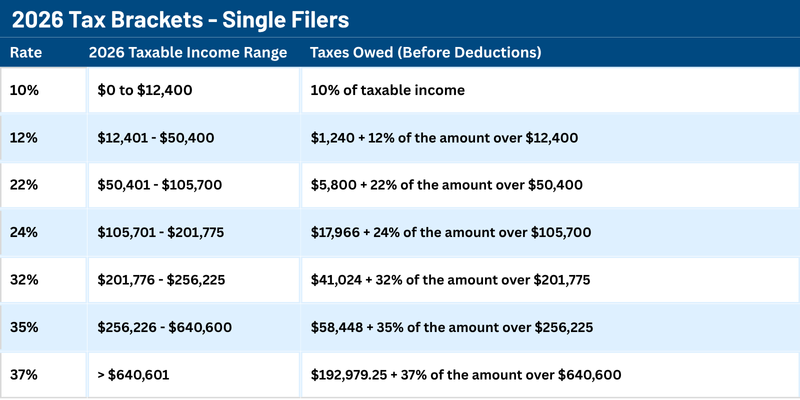

2026 Tax Brackets - Single Filers

For most single filers, these modest threshold increases mean minimal changes to effective tax liability-though withholding adjustments may be worthwhile heading into Q1.

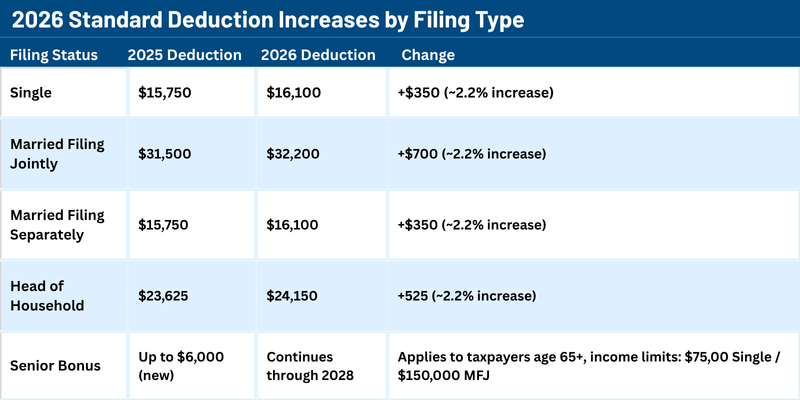

For tax year 2026, the standard deduction for single filers is $16,100, up from $15,750 in 2025, according to the IRS’s inflation adjustments under the “One Big Beautiful Bill”.

This change slightly lowers taxable income for most individuals while maintaining the same seven marginal tax rates (10%–37%)

Source: IRS (.pdf)

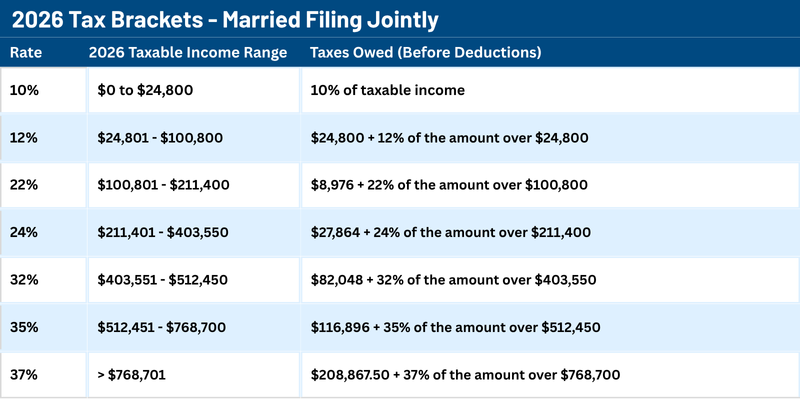

2026 Tax Brackets - Married Filing Jointly

Dual-income households benefit from continued bracket “doubling,” preserving rate parity and reducing marriage penalty exposure.

For 2026, the standard deduction for Married Filing Jointly is $32,200, reflecting the inflation adjustment and policy updates introduced through the “One Big Beautiful Bill”.

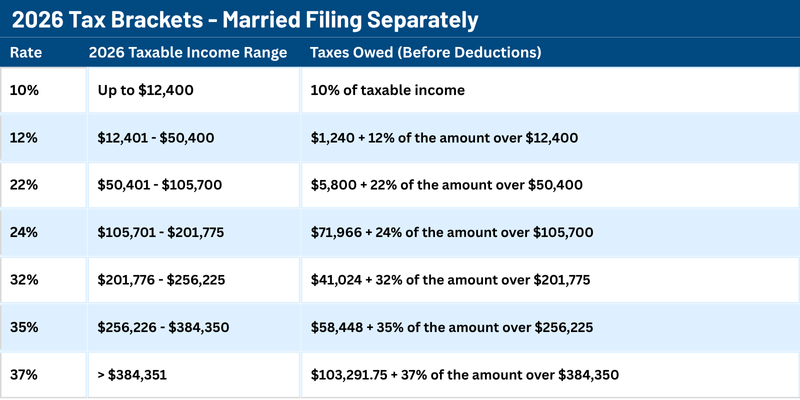

2026 Tax Brackets - Married Filing Separately

Though uncommon, separate filing may make sense in certain community-property or liability contexts. Consult a peer reviewed CPA before electing this option.

For 2026, the standard deduction for taxpayers filing as Married Filing Separately is $16,100.

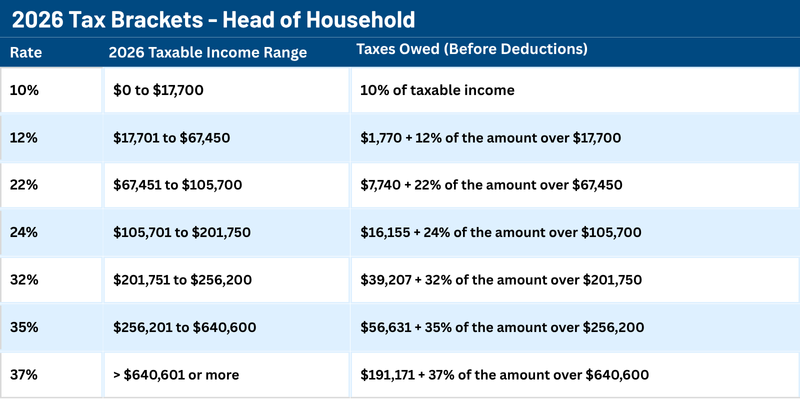

2026 Tax Brackets - Head of Household

For 2026, the standard deduction for Head of Household is $23,950, reflecting inflation adjustments set by the IRS under the “One Big Beautiful Bill” tax reform.

Source: IRS

2026 Standard Deduction Increases by Filing Type

The 2026 standard deduction amounts represent modest 2.2% inflation adjustments built into the One Big Beautiful Bill for tax year 2026, ensuring parity across filing types and expanding relief for older adults through the temporary $6,000 senior bonus deduction program.

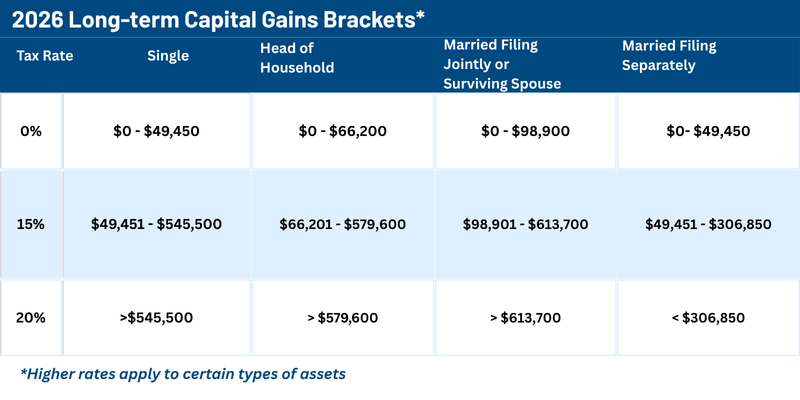

2026 Long-term Capital Gains Brackets

The long-term gains rate applies to realized gains on investments held for more than 12 months. For most types of assets, the rate is 0%, 15% or 20%, depending on your income. While the 0% rate applies to most income that would be taxed at 12% or less based on the taxpayer’s ordinary-income rate, the top long-term gains rate of 20% kicks in before the top ordinary-income rate does.

Important Notes on Capital Gains

Taxable Income: These thresholds refer to your Taxable Income, which is your Adjusted Gross Income (AGI) minus your standard deduction or itemized deductions.

Short-Term Gains: Gains on assets held for one year or less (short-term) are not subject to these rates. They are taxed as ordinary income at your normal tax bracket rate (10% to 37%).

Net Investment Income Tax (NIIT): High-income taxpayers may also be subject to an additional 3.8% NIIT on capital gains and other investment income if their Modified Adjusted Gross Income (MAGI) exceeds certain thresholds ($250,000 for married filing jointly, $200,000 for single filers)

Key Highlights

Standard Deduction: Single - $16,100 | Married - $32,200 | Head of Household - $24,150. These increases average ≈ 2.5 % over 2025 and reduce taxable income by thousands before credits are applied.

Bracket Shifts: The top of the 22 % bracket for married couples moves above $200 k for the first time, while the 24 % band now extends close to $384 k. These thresholds create small planning windows for income acceleration or Roth conversions before phasing into higher rates.

Itemizing vs. Standard Deductions: Because the deduction rises again, fewer households will itemize. Taxpayers should evaluate mortgage-interest, SALT, and charitable deductions annually to determine which approach yields the lower tax liability.

Family Credits: Child Tax Credit and other family-based credits are indexed to the same inflation factors. Eligibility phaseouts now start roughly 2 % higher than 2025, though the statutory credit amounts remain unchanged at $2,000 per child (pending future legislation).

Retirement and Savings Considerations: Workers can still defer substantial income through 401(k), IRA, and HSA contributions. Contributing up to the limits may help keep taxable income within the 22 % or 24 % bands.

Planning Note: Taxpayers near the boundary between the 24 % and 32 % brackets can benefit from multi-year income planning-deferring year-end bonuses, harvesting losses, or making additional pre-tax contributions before December 31.

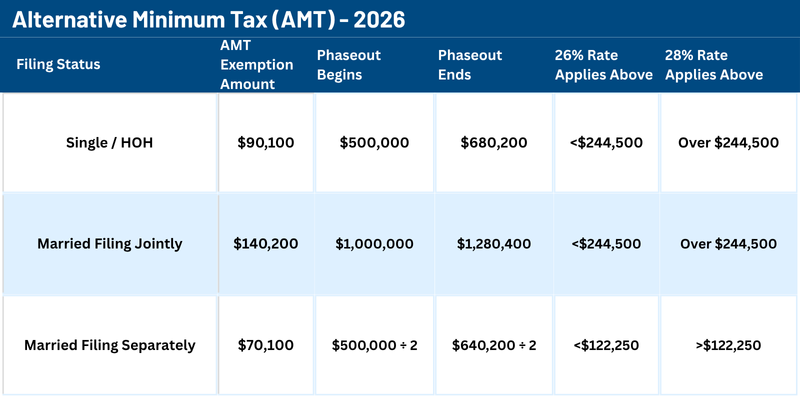

2026 Alternative Minimum Tax (AMT)

The Alternative Minimum Tax ensures higher-income filers pay a minimum amount of federal tax after deductions.

For 2026, exemptions rise to roughly $90 k (single) and $140 k (MFJ), while phase-outs begin at about $500 k and $1 million of AMT income.

These higher thresholds slightly reduce AMT exposure for executives exercising incentive stock options or realizing large capital gains.

High-income taxpayers and families with sizable estates should pay close attention to the inflation adjustments that affect both AMT exemptions and estate-transfer limits.

While these numbers impact a smaller share of households than the standard brackets, they play a decisive role in long-term tax and wealth-transfer strategy.

The AMT ensures high-income taxpayers pay at least a minimum level of tax by limiting deductions and treating certain income items differently. For 2026, the exemption amounts rise slightly due to inflation, but phaseout thresholds drop significantly, meaning more upper-income filers could face AMT liability. The AMT exemption amounts were significantly increased under the TCJA. The OBBBA makes the higher exemptions permanent, continuing to index them for inflation.

FAQs - 2026 Federal Tax Changes

Individual Taxpayer FAQs

Q: What are the new 2026 income-tax brackets?

A: The seven-bracket structure (10 %- 37 %) remains. For single filers, the top 37 % rate now begins at $609,350; for married couples filing jointly, $731,100.

All thresholds increased about 2 %-3 % from 2025, reducing the portion of income taxed at higher rates.

Q: How much did the standard deduction increase?

A: 2026 standard-deduction amounts are $16,100 (single), $32,200 (MFJ), and $24,150 (HOH) - each roughly $400–$800 higher than 2025.

Q: Will the SALT deduction cap change in 2026?

A: Yes - the cap will change. For tax year 2026, the SALT cap increases from the longstanding $10,000 to $40,400 for most taxpayers (joint filers) under OBBBA. There is a phase-out for higher-income taxpayers (MAGI over about $505,000 in 2026) and the cap is scheduled to revert to $10,000 in 2030 unless further legislative change occurs.

Q: Do the 2026 inflation adjustments affect Social Security or Medicare taxes?

A: Indirectly. Higher wage bases trigger larger payroll-tax withholding, but the income-tax bracket adjustments do not alter FICA rates.

Q: What planning steps make sense before year-end 2025?

A: Consider accelerating deductions, finalizing Roth conversions, or completing charitable gifts before new thresholds reset in 2026. Review estimated-tax payments with your CPA.

Preparing for the 2026 Filing Season

With inflation adjustments now confirmed, early planning ensures 2026 begins without surprises.

Here are a few straightforward steps to discuss with your CPA before year-end 2025:

Refresh withholding and estimated payments. Update Form W-4 or quarterly vouchers to match your 2026 bracket and deduction levels.

Maximize pre-tax opportunities. Contribute to 401(k), IRA, and HSA plans to keep income in favorable brackets.

Revisit itemizing triggers. Compare the new standard deduction against your mortgage interest, SALT, and charitable contributions.

For business owners: Time equipment purchases and compensation decisions to capture the final years of enhanced expensing and bonus depreciation.

For estates and trusts: Confirm that exemption elections and gifting strategies are current under the $15 million exclusion.

Conclusion

The 2026 tax year introduces modest but meaningful changes. Higher standard deductions, widened brackets, and updated AMT provide breathing room, while business incentives under the OBBBA continue to reward timely investment and planning.

Understanding how these updates interact with your income and long-term goals is the key to maintaining tax efficiency through the next cycle of reforms.

Let’s Plan Your 2026 Tax Year Strategy

Every taxpayer’s situation is different.

Schedule a personalized planning session with Millan & Co. CPAs to align your income, deductions, and entity structure with the 2026 thresholds.

Our firm's aim is to solve complex business and individual tax matters and provide the highest level of service to our clients and associates.

Your journey to financial success starts with a conversation. Contact us today to explore how our expertise can help you achieve your goals.