A Guide To Cryptocurrency Taxes

Millan + Co. CPAs | Austin, TX

Cryptocurrency Tax Guide Summary

- Cryptocurrency Taxes 101

- Taxable and non-taxable crypto events

- Calculating cryptocurrency tax

- Accounting methods for cryptocurrency

- Capital Gains and Cost Basis

- FIFO, LIFO and HILO accounting methods

- Reporting cryptocurrency on your taxes

- As ordinary income

- As capital gains or losses

- Cryptocurrency income tax rates and events

- DeFi (Decentralized Finance). Overview and how transactions are taxed

- DeFi Liquidity Pools and Providers

- NFTs (Non-fungible tokens) tax guidance

- Cryptocurrency exchanges and challenges with tax forms

- Crypto tax record keeping

- IRS and cryptocurrency tax tracking

- Lowering tax liability: tax loss harvesting and long-term capital gains

- Other cryptocurrency transaction types and tax treatments

- Crypto interest income treatment

- Crypto margin trading taxes

- ICOs (Initial Coin Offerings)

- Hard Forks / Soft Forks

- Airdrop tax treatment

- Crypto donations and gifts

- Crypto as Tax Investment – not obligation

- DAP Trusts (Digital Asset Protection Trusts) for crypto estate planning

This article provides an overview of U.S. cryptocurrency tax implications, what is needed to help stay compliant and the accounting methods and forms used for optimal returns.

Cryptocurrency Taxes 101

In the U.S., cryptocurrencies like Bitcoin, Ethereum and others, are treated as property for tax purposes and fall into standard capital gains or ordinary income categories. However, new advancements in cryptocurrency decentralization create some gray areas which the IRS has yet to address and senior US administration directives are underway to coordinate regulation standards between key agencies.

As with traditional types of property like real-estate, bonds and stocks, capital gains and capital losses apply to your cryptocurrency investments when you trade or sell or cryptocurrencies. Capital gain and loss percentages are based on income tax brackets and whether the capital gain is short term or long term.

Aside from trading, selling and buying, “earned” cryptocurrencies such as: mining; airdrops; staking; job / work compensation; referrals or lending based interest gains are treated as income based on the US Dollar rate of crypto earnings for tax purposes.

Cryptocurrency Taxable Events

Tax reporting is required when your crypto investing activity triggers a taxable event (when income is generated). As defined by IRS virtual currency guidance, taxable events for cryptocurrency include:

Earning cryptocurrency as income or referral rewards

Spending cryptocurrency to purchase goods or services

Trading one cryptocurrency type for another (example: Bitcoin for Ethereum)

Trading crypto to traditional currency

Non-taxable Cryptocurrency Events

Buying and holding a crypto currency such as Litecoin, Bitcoin, Ethereum as examples.

Investing into an ICO or initial coin offering.

Transferring cryptocurrency from one wallet to another that is owned by the same individual or business.

Calculating Cryptocurrency Taxes

To determine capital gains and losses from each crypto disposal, sale or trade, the following formula is used:

Fair Market Value – Cost Basis = Capital Gain/Loss

Fair market value is defined as the price an asset would sell for on the open market. In the case of cryptocurrency, this price is usually applied in USD values.

Cost basis is defined as how much money has been used to purchase property (i.e. total costs) and includes not only the purchase price but also all of the other costs associated with purchasing cryptocurrency (fees and other related costs).

For example if you buy 1 Bitcoin for $500, your cost basis is $500 per Bitcoin. If you sell or trade it when it hits $800, the $800 is the FMV or fair market value. Using the formula above:

$800 (Fair Market Value) – $500 (Cost Basis) = $300 Capital Gain

Which Method Is The Best Costing Method?

FIFO (First in, first out) is used most often because it is the most conservative method and requires the least amount of bookkeeping.

LIFO (Last in, first out) can extend the holding period of an asset, thereby avoiding the higher short-term capital gains rate.

HIFO (Highest in, first out) can help decrease taxable income since it can help realize the highest cost of goods sold.

Applying LIFO or HIFO can assist in tax savings, however, these methods can only be used if detailed crypto transaction records have been kept.

Note that, per IRS guidance, individuals and organizations can use LIFO and HIFO if the following records are maintained:

- Date and time each asset was acquired.

- Cost basis and FMV of each asset at the time acquired.

- Date and time each asset was sold, exchanged or disposed of.

- The FMV of each asset when sold, exchanged, or disposed of, and the amount of money or the value of people received for each unit.

Note that some cryptocurrency exchanges, such as Coinbase, only offer their users HIFO based tax record exports and those reports may need to be converted to FIFO or LIFO methods as appropriate. This translation process from one method to another can impact tax returns, be complicated and likely requires professional assistance. Millan and Company offers a comprehensive cryptocurrency bookkeeping service to assist in tax saving strategies for our clients.

Reporting Crypto On Your Taxes

Ordinary income is not reported on IRS Form 8949. Instead, the income earned from jobs, staking, mining or interest accounts are reported on specific schedules of Form 1040 based on the varying circumstances below.

Schedule 1 – Is used for crypto earned from forks, airdrops or other cryptocurrency wages and hobby income or “other income” on Form 1040.

Schedule B – Staking proceeds or interest income from cryptocurrency lending is typically reported on Schedule B of Form 1040.

Schedule C – Crypto earned as self-employment income, business entity or running a cryptocurrency mining operation needs to be documented on Schedule C of Form 1040.

How Much Tax Do You Pay On Your Crypto?

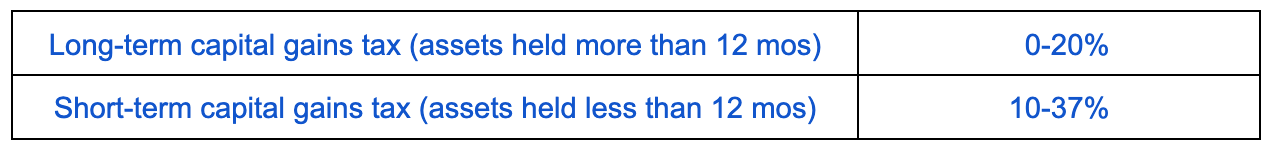

The holding period of crypto assets (short term vs. long term) and income tax brackets determine how much tax and percentage of tax is owed on crypto income.

Short-term capital gains tax term

If held for less than 12 months, short-term capital gains apply to any assets.

Short term capital gains are treated as normal income for tax purposes and are added to the personal income tax bracket schedule. This includes staking rewards, airdrops, and interest earnings.

Long-term capital gains tax term

Crypto assets held for 12 months or more are currently treated as long-term capital gains and are taxed at a lower percentage than short-term capital gains.

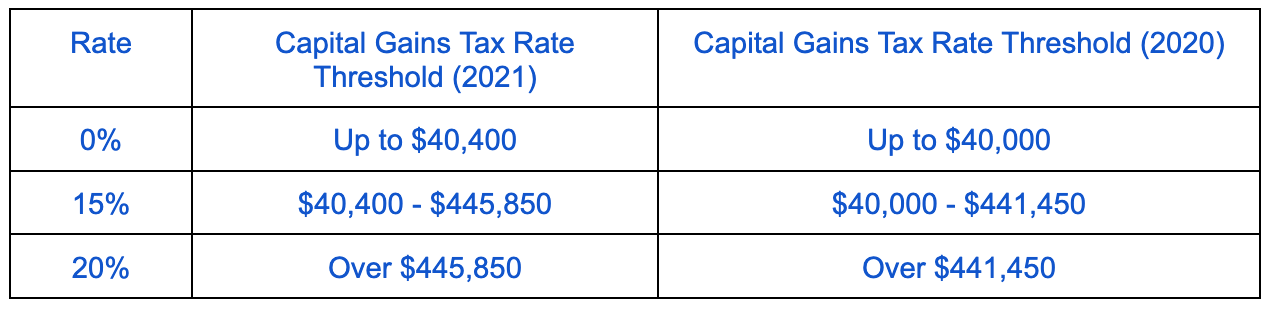

Capital Gains Brackets (2021 vs 2020)

Holding crypto assets for more than a year can yield considerable tax benefits. For example, if one falls in the highest income tax bracket, the taxes on long term capital gains will only be 20% as opposed to 37% (the highest tax rate for short term / annual income gains).

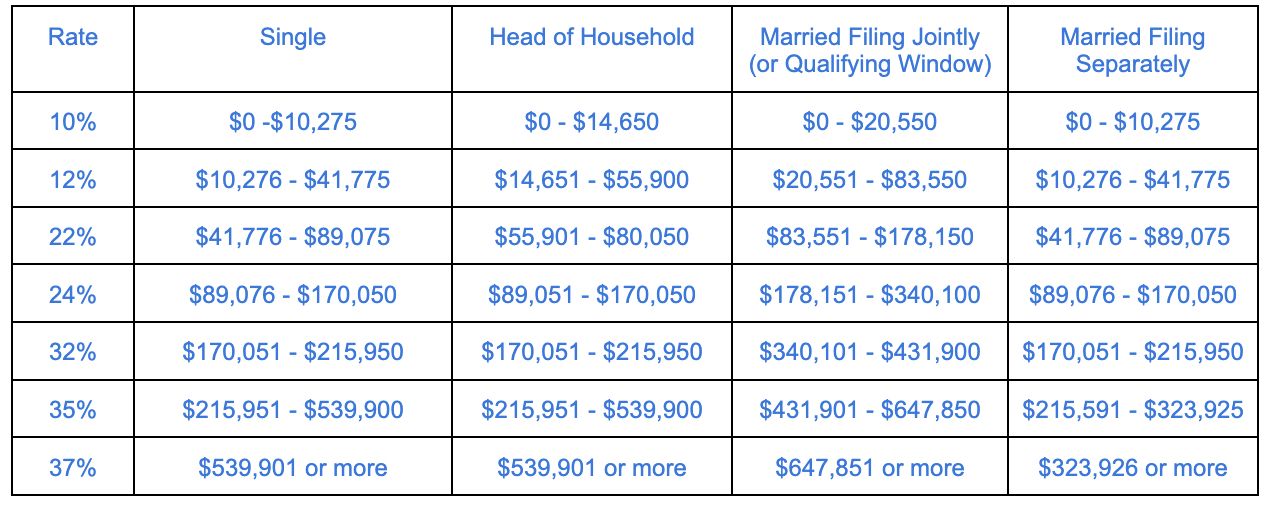

2022 Income Tax Brackets (due April 2023 or October 2023 with an extension)

DeFi (Decentralized Finance) Taxes

Cryptocurrency trading, lending and interest bearing DeFi platforms like Compound, Uniswap and Maker, to name a few, are protocols that enable digital financial services without the delays or costs of traditional banks and financial organizations.

This technology creates some unique and challenging tax situations since most DeFi protocols currently do not (and / or can not) report 1099s to the IRS due to the decentralized nature of the platforms.

The US Infrastructure Bill signed in late 2021, requires that any party that facilitates a crypto transaction provide 1099 tax reporting data to the IRS and the asset owner. The provisions of this bill do not go into effect until January of 2024. Until then, the burden is on the taxpayer to accurately report any gains or losses and leading DeFi companies will lobby against the bill via the courts. The bill may also have a disrupting effect that forces DeFi companies to operate out of the United States once the legislation goes into effect.

Though the IRS has not yet released specific guidance on DeFi taxation, receiving interest income from lending is considered a form of taxable income and is required to be reported on returns from an IRS perspective.

DeFi Liquidity Pools

These decentralized exchanges enable crypto-to-crypto trading via Liquidity Providers and Liquidity Pools aimed at earning yields. Liquidity Providers (“LP’s”) earn rewards by providing financial liquidity for different “trading pairs”. Most of these protocols provide liquidity providers tokens that can be reclaimed for their pooled assets at any time.

As with DeFi guidance in general, the IRS has not provided any specific guidance re: providing liquidity or liquidity pools. In the interim, some investors opt for either an aggressive or a more conservative method of reporting.

Aggressive Method: Until further defined by the IRS, this approach treats the exchange of crypto for LP tokens as the equivalent of a deposit.

Conservative Method: Assumes the law will treat crypto for LP tokens as a crypto-to-crypto exchange with the associated capital gains or losses incurred during the reporting period.

Other DeFi Transactions Types

Millan and Company can also help with reporting on the other types of DeFi transactions and token types where IRS guidance has not yet been provided, including: wrapped tokens, ICOs, governance / incentive tokens and crypto loan interest payments.

How Do NFT Taxes Work?

Non-fungible tokens, or NFTs, are growing with crypto native audiences, businesses, artists and are becoming mainstream. Use cases include digital art, music, licenses and certificates, collectibles, real estate and real world assets, supply chain, gaming, virtual worlds, metaverse assets, sports and more. An NFT use case overview is available here.

For taxation purposes, NFTs are treated as property. When an NFT is purchased and later sold, a capital gain or loss is required to be reported on IRS Form 8949.

Why Crypto Exchanges Can’t Provide Accurate Tax Forms

Crypto exchanges, such as Binance, Coinbase and others, do not have the ability to provide users with accurate capital gains and loss reports due to the decentralized nature of the protocols. The exchanges are blind to knowing dates, times, or the cost basis of the formerly acquired cryptocurrencies. These platforms can only see when cryptocurrency appears within the wallets of their own protocol.

Crypto Record Keeping Best Practices

Keep meticulous records of all transactions (buys, sells, trades, earnings) in order to allow your tax professional to calculate cost basis, fair market values, gains/losses, and income for all investing activity. Consolidate transaction history from all exchanges and wallets.

IRS and Crypto Tracking

The IRS uses a variety of tactics to detect cryptocurrency investments and unreported income. The most predominant of which is the 1099 reporting system.

Major exchanges like Gemini, Uphold, Kraken, and others report certain customer activity to the IRS using form 1099-K and/or other related 1099’s. These 1099’s all serve the same general purpose: to report non-employment related income to the IRS.

If the IRS receives a 1099 from a crypto exchange but sees no cryptocurrency income reported on filed taxes, accounts are flagged and a CP2000 letter will be sent to alert of non-reported income.

The IRS works with blockchain analytics companies like Chainalysis to track cryptocurrency movements directly on-chain.

Intentionally not reporting cryptocurrency gains, losses, and income on US taxes is considered tax fraud by the IRS and penalties can be severe. The IRS has also updated the main US income tax form (1040) to include a question that every US taxpayer must answer under penalty of perjury.

Lowering Crypto Tax Liability

As with any other form of income, there are certain steps and actions you can take to strategically minimize crypto-related tax obligations.

Tax-loss harvesting

Tax-loss harvesting is the practice of selling a capital asset at a loss to offset a capital gains tax liability. It provides one of the best opportunities for investors to reduce their cryptocurrency gains for the year.

Long-term capital gains

Before selling or trading, holdings should be reviewed to determine which qualify for long term gains, versus those that would otherwise be subject to short-term capital gains, in effort to help lower crypto tax liability.

Other Cryptocurrency Transactions and Tax Examples

Crypto interest income taxes

Several protocols, like BlockFi, offer users interest based rewards for holding cryptocurrencies, while many DeFi platforms offer their clients rewards for staking cryptocurrency. Crypto interest and crypto staking gains are both taxed as personal income.

Crypto margin trading

Most crypto exchanges offer margin trading. A margin trade consists of borrowing funds from an exchange to execute a trade and repaying the loan at a later point in time.

Although the IRS has not yet provided guidance on how crypto margin transactions should be taxed, the conservative and likely best approach is to treat the borrowed funds as an investment and pay capital gains on the margin based profit and loss.

ICOs (Initial Coin Offering)

Initial coin offerings are the equivalent of an initial public offering (IPO) – when a company offers shares to the public to raise capital. Investors may receive several different types of tokens in an ICO:

- Utility tokens – for help in using a specific product.

- Governance tokens – provides a vote or say to influence company policy and decision making.

- Equity tokens – represent equity shares that can be sold at a gain or loss.

Crypto ICOs are taxed differently for those launching the offering vs. investors buying into the offer, just as with a traditional IPO.

For the organization launching the ICO, investments received are treated as a type of income and income tax will need to be paid on all proceeds regardless of whether fiat currencies or cryptocurrencies are used for the funding.

For investors, most taxing authorities have not yet issued specific ICO tax policy but it is best to follow the tax treatment of IPOs as guidance. Meaning that most likely, no taxable event is triggered at the point of the investment, only when ICO assets are later sold, swapped or traded that capital gains are taxed on any profits.

Hard forks

“Hard forks“ – when a cryptocurrency undergoes a fundamental protocol change which results in a permanent diversion from the original ledger and creates a new blockchain, the newly forked crypto is taxed as income. The cost basis in the newly held cryptocurrency becomes the realized income. Hard Forks are considered a taxable event despite being an involuntary transaction by the owner or holder of the asset or token.

Forks are used to add new functions, improve security or resolve user disagreements.

Soft Forks

“Soft Forks” are an update to a blockchain but do not split the blockchain and are backward compatible.

Soft Forks are not subject to any tax as no new coins or tokens are received.

Airdrops

An airdrop is an unsolicited distribution of a cryptocurrency token or coin, usually for free, to numerous wallet addresses. Airdrops are often associated with the launch of a new cryptocurrency or a DeFi protocol, primarily as a way of gaining attention and new followers, resulting in a larger user base and a wider disbursement of coins. Airdrops have been a more important part of ICO after the crypto entrepreneurs have started doing private sales instead of public sales to raise initial amount.

The IRS is clear in its guidance regarding the income treatment of airdrops. Crypto received from an airdrop is taxed as income. If sold, traded, or otherwise disposed in the future, capital gains or losses are incurred depending on how the price of the tokens has fluctuated since initial purchase.

Crypto donations

Cryptocurrency donations are tax free and deductible so long as they are donated to a registered charity. Any deduction claims larger than $500 need to be reported on IRS Form 8283.

The amount of a donation that is tax deductible depends on how long the assets have been held:

If the crypto has been held for 1 year or more, the crypto’s fair market value can be claimed.

For crypto held for less than 1 year, deductions can be claimed for whichever is lower: the fair market value or the cost basis of the asset.

Crypto gifts

Cryptocurrency gifts are usually tax-free, however, if the donation exceeds a fair market value of $15,000, a gift tax return will need to be filed.

Crypto as a tax investment – helping to reshape taxes and cities

CityCoins is now offering a new and disruptive type of crypto token that enables “an opt-in tax of opportunity, as opposed to obligation,” where investors boost a specific city with cryptocurrency because they have faith in the municipality and its mission. This crypto token is being offered in Austin, TX, NYC and other cities across the globe. This concept may actually help shape future US crypto tax policy. More information about the concept is available here.

DAP (Digital Asset Protection) Trusts for crypto estate planning

DAP Trusts are a new type of trust formation used to protect digital assets and rights for wills and estate planning purposes. DAP trusts are very efficient regarding the protection, management and distribution of a person’s digital assets or digital estate. More information is available here.

It is strongly recommended that DAP Trust formations be formed by an estate planning attorney.

Millan & Co. is here to assist you with cryptocurrency taxes

Our leadership team tracks regulation and cryptocurrency tax changes to help guide our clients in the rapidly changing digital currency ecosystem and provides strategic accounting expertise to assist meeting the goals of individuals and businesses of all sizes.

Contact us today to learn how we can help you create a sound cryptocurrency strategy.